What the Artiva IPO says about the state of cell therapy for autoimmune disease

Examining the Artiva IPO and what it means for cell therapy, B-cell driven autoimmune disease, and more

Guess what, reader? Your sponsorship could go right here at the very top of the next Big Pharma Sharma post.

A sponsored post is 100% accessible to all subscriber levels and gets your brand, product, or service in front of my audience of BioPharma Industry decision-makers.

If you or your company is interested in becoming a Big Pharma Sharma sponsor, please reach out to me here or on my socials. Click the button below to learn how you can sponsor the next edition of Big Pharma Sharma.

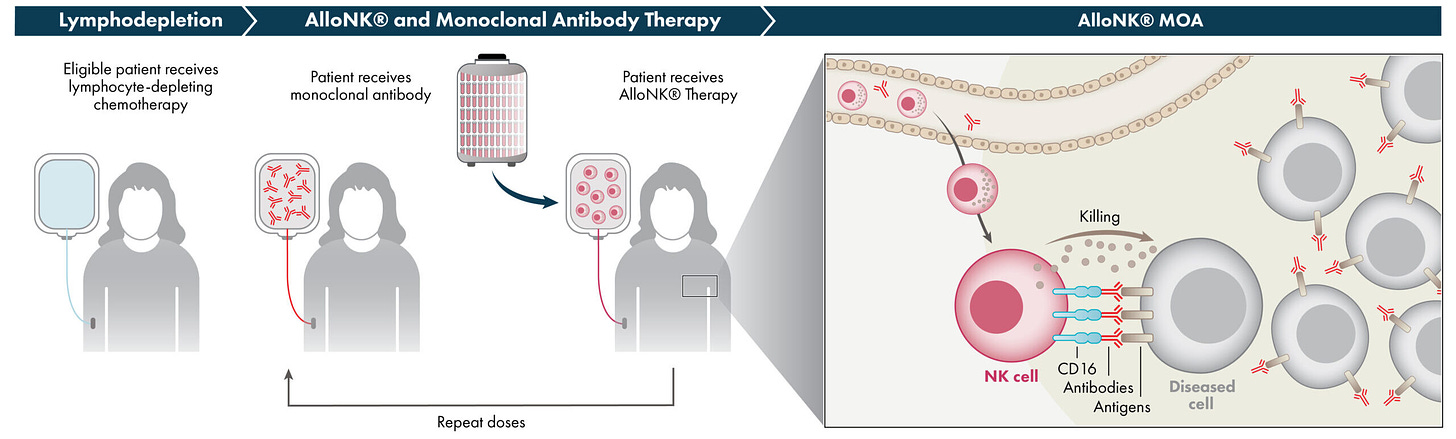

NK cell therapy company, Artiva (ARTV) went public last Friday. The company priced its IPO at $12 per share, raising an upsized $167M in the process. The company’s lead program, a cordblood derived NK cell therapy, selected for high affinity CD16 and KIR-B haplotype, in combination with CD20 antibodies is currently in P1 for lupus nephritis, after previously being developed from NHL and cHL, joining the swarms of heme/onc cell therapy co’s who have pivoted into B-cell driven autoimmune diseases1.

I have to admit, seeing this news before the weekend really surprised me. No, not the part about ARTV pivoting into autoimmune disease – that has certainly been faire fureur at the moment. Not even ARTV seeking an IPO in the first place, as they flirted with the idea back in 2021 according to many reports. What really shocked me was how much money raised, especially that they raised far more than what they expected. $167M feels like a lot of money in this case. Granted, it is shadowed by the likes of Kyverna whose raised $319M in its IPO, but Kyverna actually had clinical data in hand. For a company with no clinical data in its therapeutic area of interest, $167M is a lot.