What the Ivonescimab Data at WCLC Tells Us About China's Role in Drug Development

Below I get into my quick thoughts about the ivonescimab HARMONi-2 data and our need to change our view on ex-US/EU data readouts.

Any time you see a new drug beat Keytruda in a head-to-head study, it’s a big deal. That’s exactly what we saw with ivonescimab (developed by Akeso) in the Phase 3 HARMONi-2 study, which was presented this week at the WCLC conference. But before we get too far ahead of ourselves, let’s take a step back and break this down.

Back in June of this year, just before ASCO, Akeso and Summit press released topline data saying that its PD-1 x VEG-F bispecific antibody, ivonescimab (ivo), “decisively” beat Merck’s blockbuster PD-1 antibody, Keytruda (pembrolizumab) in a head-to-head study in 1L NSCLC patients without driver mutations. Over the weekend at WCLC, we got to finally see exactly how decisive that victory was when Akeso presented the full data for HARMONi-2.

Interested in becoming a BPS sponsor?

A sponsored post is 100% accessible to all subscriber levels and gets your brand, product, or service in front of my audience of BioPharma Industry decision-makers right at the beginning of my next post.

If you are interested in featuring your company, product, or services in my next post as a Big Pharma Sharma sponsor, please reach out at info@bigpharmasharma.com. Click the button below to learn how you can sponsor the next edition of Big Pharma Sharma.

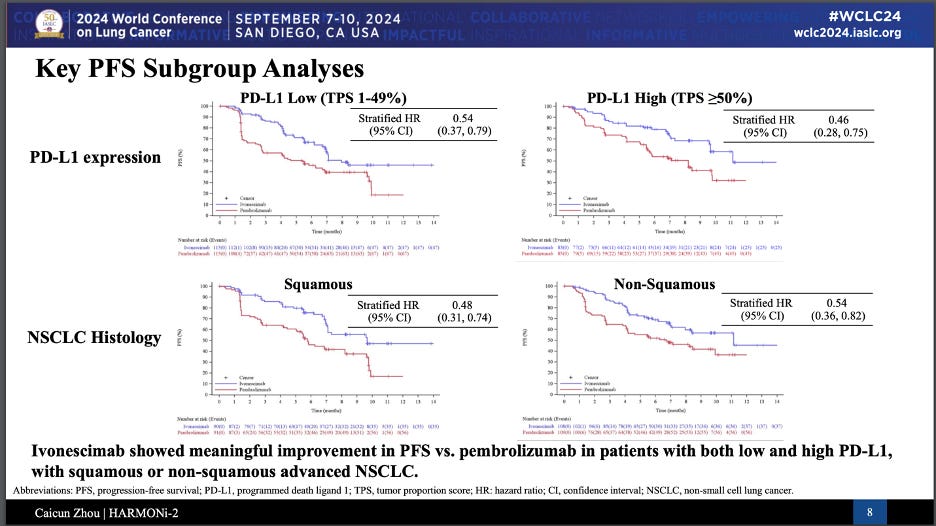

Ivo demonstrated a mPFS of 11.14 months vs. 5.82 months in pembro arm, amounting to 49% risk reduction after a median follow-up of 8.67 months. More interesting were the PFS curves split out by key subgroups, where the risk reduction remained relatively consistent, albeit with slight improvements in the PD-L1 high and Squamous sub-populations.

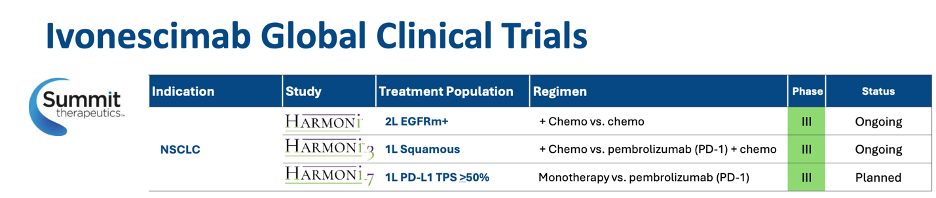

First off, the results are impressive—there’s no denying that. Any drug that outperforms Keytruda, particularly in a first line setting for NSCLC (non-small cell lung cancer), deserves attention. But there are some caveats here that we need to consider. The study was conducted only in China, with a Chinese patient population, and the comparator arm used pembrolizumab (Keytruda) monotherapy—something that’s not standard of care for PD-L1 low patients in 1L NSCLC, who usually get a combination of pembrolizumab and chemotherapy. Another critical factor: the study focused on progression-free survival (PFS) as the primary endpoint, and while the PFS benefit is striking, follow up is still short and overall survival (OS) remains the gold standard in this indication. We’ll need to wait for OS data, but early separation of curves suggest ivonescimab could outperform Keytruda there as well, notably in the PD-L1 high subgroup, which is more representative of the SoC.

One red flag, though, is the underperformance of the Keytruda monotherapy arm, especially in PD-L1 high patients. In HARMONi-2 the pembro arm registered an 8.2 mo mPFS vs. 10.3 months seen in Merck’s KEYNOTE-024 study in the same population. It isn’t entirely uncommon for comparator arms to diverge from the studies they were once approved on. Every clinical trial is different, and we always like to say “real world” performance of drugs tends to fall slightly short of the hyper-controlled meticulously patient-selected clinical trial setting. In any case, this certainly raises questions about how these results compare to global data on pembrolizumab’s efficacy. It’s something that can’t be ignored, but it doesn’t take away from the fact that ivonescimab has shown impressive efficacy in this setting.

The jury is still out on whether ivo will be an approvable drug in the US/EU, but I personally have a hard time not feeling there is a much clearer path forward for this product, especially in the PD-L1-high setting, in which it ivo is being tested in the forthcoming HARMONi-7 study. Overall, with each new P3 update, albeit in China, this drug’s probability of success continues to increase.