Three Major Implications Coming out of ESMO 2024

Three big strategic implications from three-ish data readouts we saw at ESMO

ESMO just wrapped up in Barcelona and there was a whole lot of interesting data coming out of the conference. I won’t have time to cover it all in detail, but I thought it would be helpful to cover some broader takeaways evolving out of some key data readouts at the conference.

Below I’ve highlighted my three biggest implications stemming from data presented at the conference. Some of these are reconfirmations of my prior convictions and others are new insights entirely. I’ll be keeping track of these as we learn more and ultimately see whether these assertions bear out to be true or not.

Without further ado, let’s get into it.

#1 - Replimune’s RP1 data looks pretty good and may signal commercial challenges for melanoma cell therapies

Small cap Replimune REPL 0.00%↑ presented pivotal data for its lead oncolytic virus program, RP1, in 2L+ PD-1 exposed melanoma. This is the same target indication that cell therapies like Iovance’s IOVA 0.00%↑ AMTAGVI (TIL therapy) are approved in and other cell therapies, like Immatics’ IMTX 0.00%↑ IMA203 (PRAME TCR-T) are looking to enter. If you’ve been a BPS reader for a while, you’ll recall that I’ve talked about Replimune and RP1 a fair bit in the past. In short, they are trying to make oncolytic viruses sexy again. Onocolytic viruses were, at one point, a buzzy therapeutic strategy that led to the approval of Amgen’s AMGN 0.00%↑ IMLYGIC, which for the most part has been a commercial flop. The challenge with this class of therapies has always been whether injected the oncolytic virus into accessible tumor lesions also causes tumor shrinking in non-injected lesions (aka the abscopal effect). At least in the case of RP1 it seems like this isn’t an issue.

The combination of RP1 with nivolumab (PD-1 mAb) in 140 patients who had failed prior PD-1 based therapy demonstrated a 34% overall response rate (ORR) and a 15% complete response rate (CR). Notably, injected and non-injected lesions seemed to response similarly across the patient population. Median duration of response was 22-months with 85% of responses ongoing for over one year. Survival rates in the single-arm population were as good as 55% at 36-months with median overall survival not yet reached.

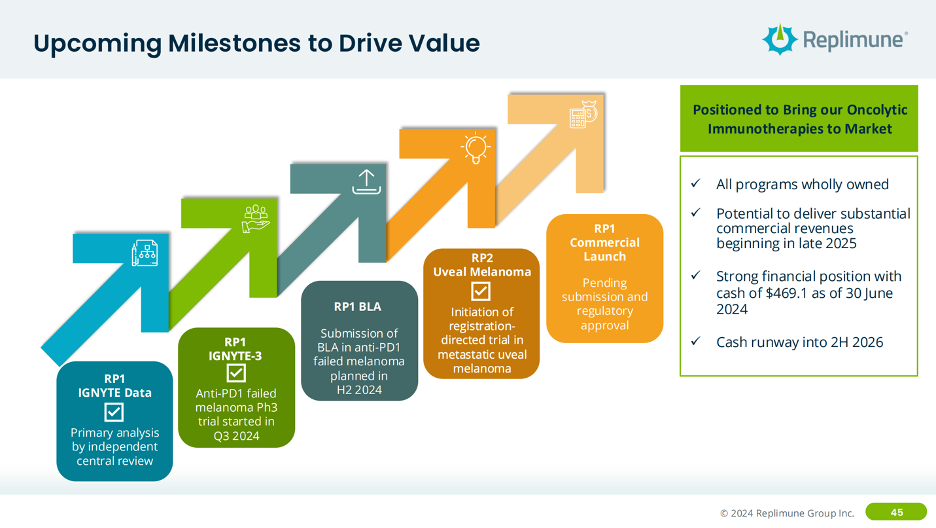

The next step for RP1, per their post-ESMO investor call, is to initiate the confirmatory Phase 3 study this quarter and file the RP1 BLA in 2L+ melanoma by the end of the year.

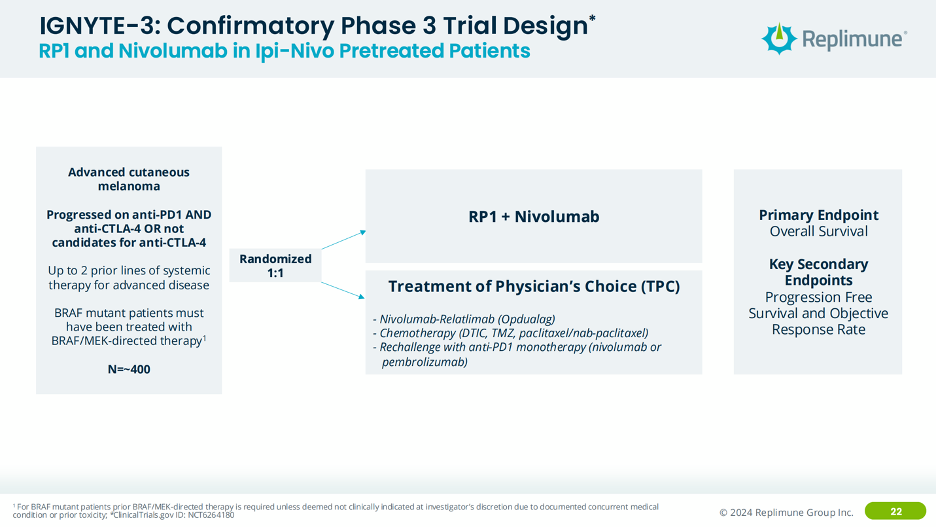

Interestingly, for RP1’s confirmatory study, they are going after the same 2L indication but in patients who have experience both nivolumab and ipilimumab (CTLA-4 mAb) or those who aren’t candidates for ipilimumab, randomized versus physicians’ choice of standard of care. From a product strategy perspective, I’m not sure that really increases your eligible patient population all that much, given that the use of PD-1 + CTLA-4 is likely decreasing as OPDUALAG (PD-1 + LAG-3) increases over time. The logical option would have been to study RP1 in 1L melanoma, however perhaps this patient population section was a stipulation from the FDA that Replimune couldn’t get around.

When you compare RP1’s product profile vs. AMTAGVI, on the surface it stacks up quite nicely. However, there are clearly nuances within each study that are driving the differences you see in response in this side-by-side comparison. Most notably the number of prior treatments in both populations. Typically, the more heavily pre-treated a patient population is, the harder it is to generate durable responses. RP1 generated a similar ORR but deeper responses and achieved potentially better survival in a less heavily pre-treated population.

Interested in becoming a BPS sponsor?

A sponsored post is 100% accessible to all subscriber levels and gets your brand, product, or service in front of my audience of BioPharma Industry decision-makers right at the beginning of my next post.

If you are interested in featuring your company, product, or services in my next post as a Big Pharma Sharma sponsor, please reach out at info@bigpharmasharma.com. Click the button below to learn how you can sponsor the next edition of Big Pharma Sharma.

The quirky thing here though is that if/when RP1 is approved, and their on-label data looks similar to what they presented at ESMO (which by the way isn’t a guarantee; it is not uncommon for efficacy data, especially response rates, to be quite different after the FDA has done their own analysis during the BLA review process) both RP1 and AMTAGVI will likely be indicated for the similar, if not the same, patient population. If you look at the two data sets and roughly discount the RP1 data for being in a less heavily pre-treated patient population, AMTAGVI, which generated similar-ish data in a much more heavily pretreated patient population would seem like the more powerful therapeutic option.