Priority Review Voucher (PRV) Market Update – Big Pharma Unloading its Ammo

Refreshing my PRV tracker database and providing you with the latest analysis of this interesting market

One of the first posts I published on BPS was about priority review vouchers (PRVs) and the market of buying, selling, and trading these FDA fast-passes that has taken place. You would think there would be one unified database tracking this sort of thing, but unfortunately that isn’t the case. There are a lot of great sources (listed in previous post) that have pulled together different pieces of this market and that track developments in this space, but I found that I needed to build my own to fill in all the gaps I was finding. Even then, some of this information who specific buyers are, how much they’ve spent, what drugs or TAs they’ve redeemed vouchers for are undisclosed or yet to be disclosed. The FDA often reports on granting and redemption of PRVs (you can find these reports on the Federal Register website), but as you’ll see below, sometimes they are months if not years behind on reporting, especially when it comes to when big pharma companies have redeemed PRVs to fast track one of their potential block buster drugs

I went back into the database for an update/refresh this time around and surprisingly found a lot of new activity that has shifted my previous analyses quite considerably. Below is that update with new and improved graphs and charts.

Recent Updates

Guess what, reader? Your sponsorship could go right here at the very top of the next Big Pharma Sharma post.

A sponsored post is 100% accessible to all subscriber levels and gets your brand, product, or service in front of my audience of BioPharma Industry decision-makers.

If you or your company is interested in becoming a Big Pharma Sharma sponsor, please reach out to me here or on my socials. Click the button below to learn how you can sponsor the next edition of Big Pharma Sharma.

Six new PRVs enter the market with all of them being of the rare pediatric type (the most common type). No surprise, all of them are from small companies. Orchard Therapeutics was acquired by Kyowa Kirin earlier this year for $477M. Selling that PRV it just acquired too could help shave that price tag down by another ~20% or so.

Day One has put its capital to quick use following its first approval, striking a commercialization deal with Ipsen and in-licensing an ADC asset to build out its pipeline. A PRV sale could help provide the company further firepower to bring in another pipeline program.

On the redemptions side, the FDA was certainly catching up on a backlog of redemptions, highlighting five that happened in 2020 or 2021. The one that stood at most to me was the most recent one by Novartis, using one of its many accumulated PRVs to fast pass KISQALI in early HR+/HER2- breast cancer, presumably to accelerate commercial launch in the adjuvant setting.

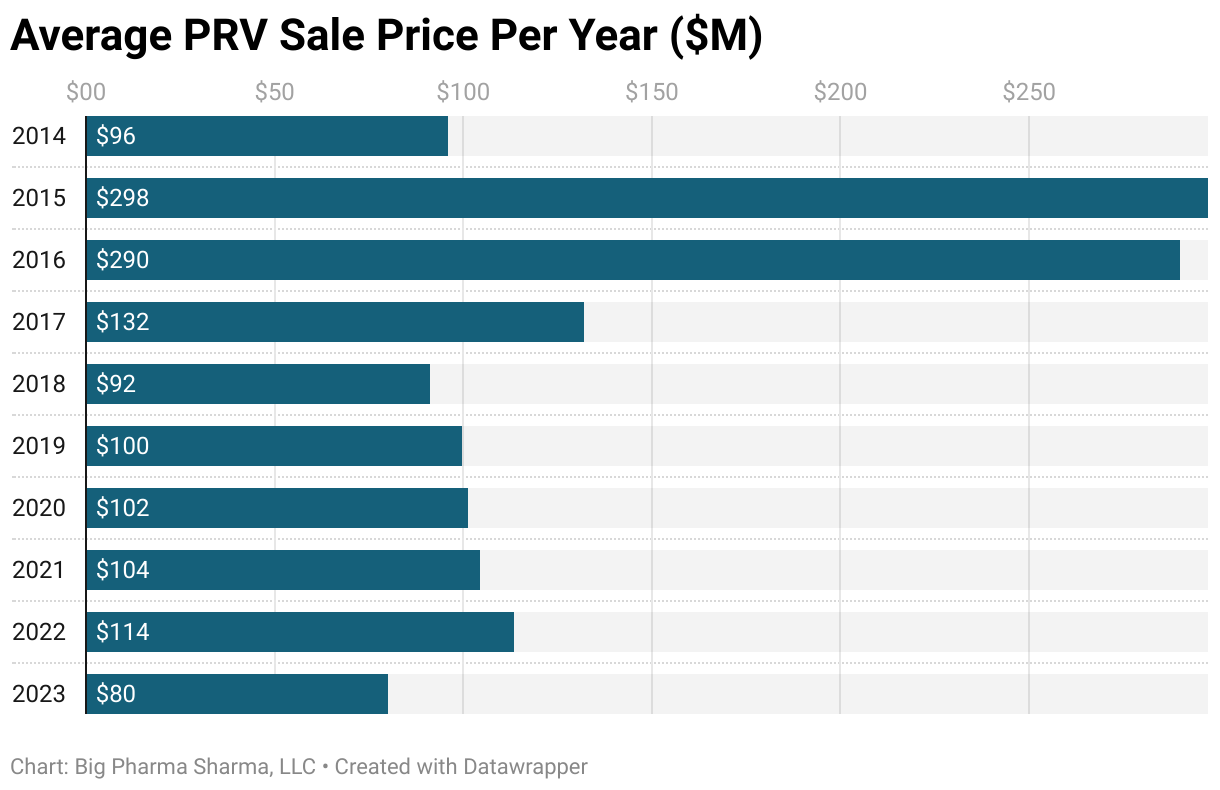

PRV Prices Year-Over Year

This data largely hasn’t changed much since my previous update. However, I will call out the slight dip to ~$80M in “fair market value” for PRVs in 2023. Since 2018 the FMV has stayed stable around $100M. In 2023 though we saw a couple instances of companies “pre-buying” PRVs. The most notable one here is Novartis agreeing to buy a PRV from Pharming back in 2019 for the paltry price of $21M, which ended up conveying to Novartis in 2023, thus pushing down the average price significantly. Removing that outlier though, the PRV price still is hovering around the $100M mark.