Deconstructing GRANITE's Downfall: Perils for the Neoantigen Vaccine Field?

Below I dig into the negative data from Gritstone's P2/3 GRANITE neoantigen vaccine program and what it could mean for other players like Moderna and BioNTech

Hello reader! Your sponsorship could go right here at the very top of the next Big Pharma Sharma post. A sponsored post is 100% accessible to all subscriber levels and gets your brand, product, or service in front of my audience of BioPharma Industry decision-makers. If you or your company is interested in becoming a Big Pharma Sharma sponsor, please reach out to me here or on my socials. Click the button below to learn how you can sponsor the next edition of Big Pharma Sharma.

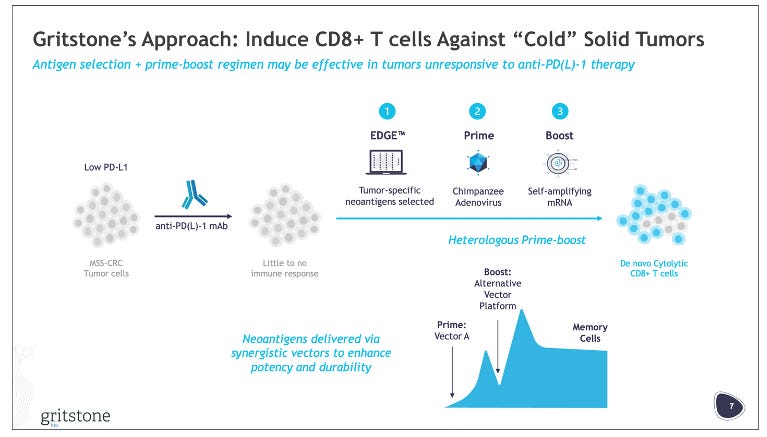

On Monday, April Fool’s Day, Gritstone reported preliminary P2 data from its P2/3 study of its personalized cancer vaccine, called GRANITE. GRANITE is a heterologous (chimp adenovirus + self-amplifying mRNA) vaccine studied with checkpoint inhibitors (CTLA-4i + PD-L1i) and chemotherapy in 1L untreated MSS-CRC. As you can probably tell form the title of this post, the data was negative, with the study missing its primary endpoint of ctDNA response and did not show any PFS benefit.

If you read the company’s press release though, as I did, you would have thought that the study was positive or at least a poor attempt at an April Fool’s joke.

“Today's preliminary Phase 2 results are highly encouraging and represent the first randomized trial evidence, albeit early, that a personalized neoantigen-directed vaccine can potentially drive efficacy in a metastatic ‘cold’ tumor. The overall trend of PFS improvement in GRANITE recipients is great to see, and the exploratory PFS hazard ratio of 0.52 in the high-risk group, a more mature dataset, is a striking signal…We believe these preliminary findings put us in a strong position to share mature PFS data in the third quarter and then enter regulatory discussions regarding Phase 3. The growing body of evidence favoring GRANITE in this trial, including positive PFS and long-term ctDNA trends in both high and low-risk populations, is exciting and suggests GRANITE is working in this notoriously underserved patient population.” - Andrew Allen, MD, PhD, Co-founder, President & CEO of Gritstone bio.

We’ll get into the details of the reported data below, but the company noted that setting short term ctDNA response as the primary endpoint was a mistake, given the impact of chemotherapy in both arms on the ctDNA response. Gritstone appears confident that the long-term ctDNA response and PFS trends indicate GRANITE is providing benefit. The company expects to share P2 PFS data in Q3’24 before entering regulatory discussions about the P3 portion of the study. They are in a bit of a cash crunch, issuing layoffs last month to extend their runway, and oddly priced a secondary offering of ~$33M after these negative results. We will soon see if forthcoming PFS data revive the company’s outlook, or if they will need to pivot to their other pipeline programs, or close shop. Gritstone’s market cap is about 1/10th of what it was at peak in 2021, when the company was value at ~$1.3B.

These new results got me thinking about a couple of things:

1. Why did this data flop? Was it poor study design/endpoint selection? Suboptimal indication selection?

2. What do these results say (if anything) about the prospects of other personalized cancer vaccine readouts on the horizon from players like BioNTech and Moderna?

Let’s get into it.

Endpoint selection and regimen changes between P1/2 and P2/3 smell like trouble

GRANITE was initially tested in combination with nivolumab (PD-1i) and ipilimumab (CTLA4i) in the P1/2 solid tumor basket study, which included MSS-CRC patients. Notably no patients in this study achieved a response, except for one patient with gastric cancer who achieved a complete response (CR). Gritstone opted to advance development into MSS-CRC, an indication in which seven patients in the study achieved a stable disease (SD). In analyzing this subset of patients Gritstone determined that changes in ctDNA levels as a biomarker for survival outcomes, noting that molecular responders (≥30% reduction in ctDNA) had improved mOS (see slide image above).

Strangely, the company opted to use a slightly different regimen in their randomized P2/3 study, studying GRANITE + ipilimumab + atezolizumab (PD-L1i) with bevacizumab + chemotherapy maintenance after an initial 5-month phase of chemotherapy induction. Let’s assume switching to a PD-L1 inhibitor from a PD-1 inhibitor didn’t have a noticeable impact. The control arm of the study received chemo-induction plus the beva + chemo maintenance regimen. Per the company’s press release, they felt the addition of chemotherapy to the P2/P3 study design was a mistake, however they note that this was because patients in the control arm had an “unexpectedly persistent” drop in ctDNA beyond the induction chemotherapy phase, which confounded the results.

To me this read as a poor excuse for the “molecular response” endpoints (i.e. the ≥30% reduction in ctDNA) they used in the P1/2 not being a good endpoint and/or their drug combination simply not being good enough to beat chemo. ctDNA reductions don’t really mean much without knowing how that maps back to actual RECIST response, in my opinion. Also, if the ctDNA measurement was supposed to indirectly show reduction in overall tumor burden, wouldn’t you expect patients to see a reduction in ctDNA after being treated with chemotherapy? This seemed obvious to me, so unless I am missing something, I am assuming it was obvious to much more intelligent clinicians designing the study, so the selection of this short-term endpoint as the primary is quite odd.

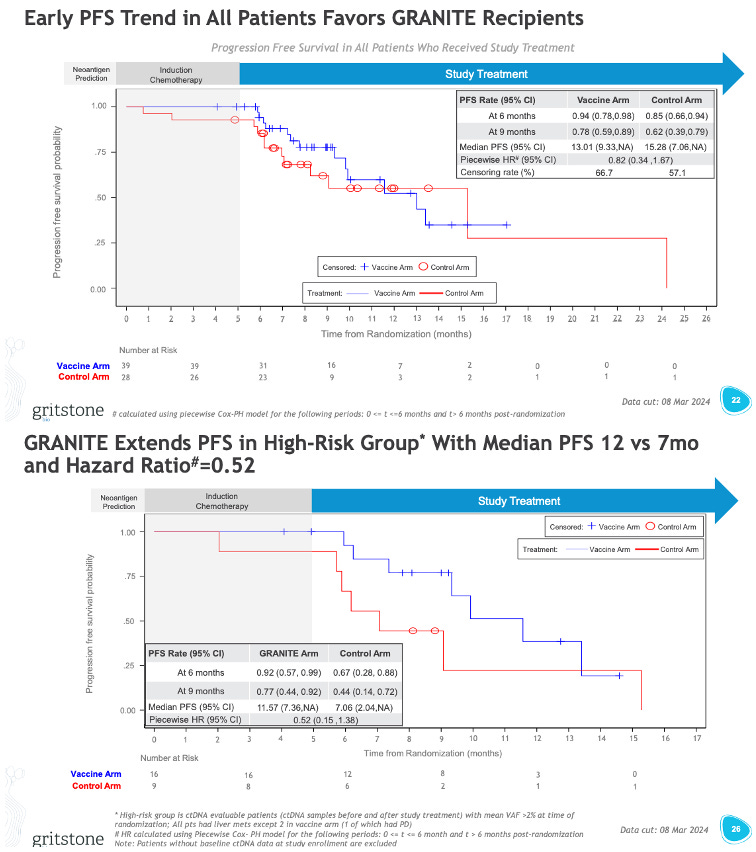

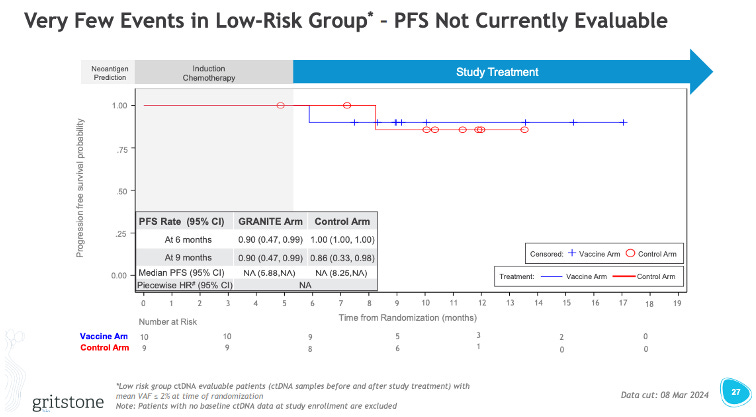

Gritstone is more optimistic about the long-term changes in ctDNA, noting that of patients who ended induction with high levels of ctDNA 56% (9/16) vs. 22% (2/9) control arm patients saw a shift to low levels of ctDNA. For patients who ended induction ctDNA-negative, 67% (6/9) sustained ctDNA negativity vs. 38% (3/8) for the control patients. The company noted that these findings align with the “positive” trends in PFS. I’ll let you decide how positive these PFS trends look (see the chart below).

I guess weirder things have happened in the world of PFS curves, so perhaps with longer follow-up these curves start to separate and the PFS looks better. I have my doubts. None of these PFS curves look great. Perhaps this high-risk group (basically the patients with high ctDNA even after induction) looks to have a glimmer of hope, and the extraction of this subset is potentially a clever way Gritstone can revise its P3 design to just target this subset of patients.

The moral of the story here is that it’s quite risky to make really big changes in treatment regimen going into your late-stage study. Gritstone may have been better off expanding the P1/2 study a bit to test out this induction + maintenance schema before going all-in on a pivotal P2/P3.

Additionally, ctDNA as a measure of response in a metastatic cancer population may not be all that valuable, without the context of radiographic response and those responses showing an improvement in survival. The paper Gritstone references, which seemingly informed much of their biomarker thresholds, says as much. The value of ctDNA in this context is as a supplement to radiographic response, specifically in patients with SD who may be showing a reduction in ctDNA and thus derive longer term benefit from treatment. ctDNA is a super interesting and emerging tool in cancer diagnostics/prognostics but may be better suited for measuring sustained regression of disease/relapse free survival in an earlier line setting.

Indication selection and MOA considerations may explain a lot

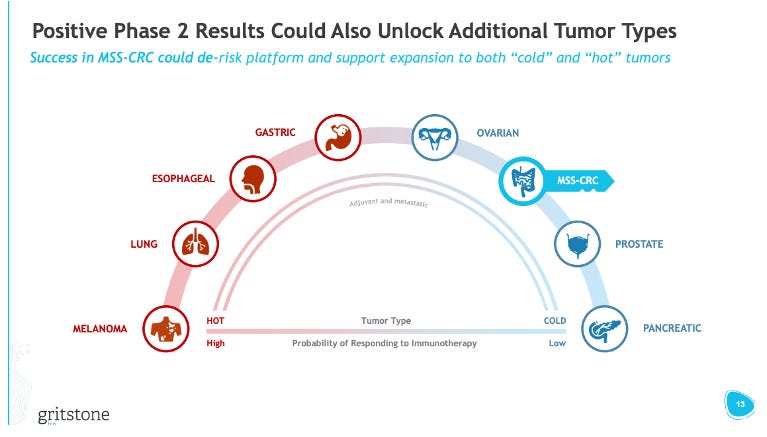

Gritstone obviously chose to go into MSS-CRC as the first indication for GRANITE. This was an intentional choice to go into a “cold” tumor vs. “hot” tumors, like melanoma, where other players in the neoantigen vaccine space are starting off. The strategy here was to show that GRANITE could generate activity in “cold” tumors, opening possibilities to address even more immune-restricted tumors, like pancreatic cancer, while also providing a positive readthrough to GRANITE’s effectiveness in “easier” to treat “hot” tumors (i.e. “if it works in CRC, it probably works well in melanoma”).

Going after cold tumors with an immunotherapy is a high bar. These tumor types are responsible for the death of many once-sexy MOAs like TRAIL, VISTA, and STING. From Gritstone’s P1/2 data though, they had another option on the table they could have explored further – gastric cancer. Recall, they saw a CR in one patient with gastric cancer (and another patient with stable disease). Gastric cancer might have been a slightly lower bar (immunogenically), but also a sizeable market with strong unmet need (i.e. PD-1 + chemo in 1L results in a 1–2-month OS benefit), enabling the company to still demonstrate the market potential of a personalized cancer vaccine product and have some positive readthrough into more/less immunogenic tumors. I think it was a missed opportunity to not study additional patients in gastric cancer to flesh out this response signal further before deciding the P2/3 indication.

Nonetheless, Gritstone chose to go with CRC. I get it – if the drug hits in CRC it looks like a very attractive asset. CRC is growing in incidence and occurring in younger populations at greater rates than in the past. The disease is dominated by chemo-based regimens, with I/O therapy not being all that effective. However, I’m not sure the MOA of GRANITE fully solves the underlying issue in a cold tumor like MSS-CRC. If we think about the world of TILs, there have been many past studies showing the feasibility of extracting and manufacturing TIL therapies in CRC, but with treatment with these TILs have shown mixed results. One way of thinking about GRANITE is that it is effectively trying to induce more TILs in the patient by triggering an immune response to the predicted neoantigens. Simply increasing the number of neoantigen-reactive T-cells does not immediately turn a cold tumor hot and reach the necessary “therapeutic escape velocity”, so to speak, needed to kill a tumor.

It's likely that there are other mechanisms at play in the tumor microenvironment that are suppressing infiltrating T-cells (beyond what standard checkpoint inhibition can overcome) or, more interestingly, the predicted neoantigens are either insufficient or therapeutically irrelevant to the cancer itself. Remember, neoantigens aren’t the only antigens, and may not always be the “best” targets, expressed on a tumor. Prediction algorithms that simply look at DNA mutations will miss the swath of non-DNA based neoepitopes created in a tumor by way of RNA splicing errors, post-translational modifications, and other protein manufacturing errors that aren’t coded at the genomic level. In some respects, it is presumptive to think that we can accurately predict the best targets to immunize against a patient’s cancer without complete visibility into how the tumor-specific antigen was generated. We may not have enough information in our algorithms to predict the right ones, or worse, enough of the right ones (i.e. the proper breadth of targeting) needed to amount an immune response that can overwhelm a tumor. Especially in tumors that have already reached the metastatic stage, tumor burden tends to be high, with regional tumor sites expressing different sets of antigens (including some shared antigens). The breadth of targeting needed to overcome a metastatic tumor is likely far greater than that of an earlier stage tumor.

My guess is CRC isn’t solvable by GRANITE’s MOA of increasing the number of CD8+ neoantigen-reactive T-cells. The biology of tumor likely requires more T-cell infiltration, with better and broader targeting, in addition to other elements like cytokine support, recruitment of other immune cell types, and inhibition of suppressor cells – another reason why building out more signal in gastric cancer before proceeding to a P2/3 could have provided Gritstone with another “out” for this program and de-risked its pivotal path a bit more.

Will Moderna and BioNTech meet the same fate as Gritstone?

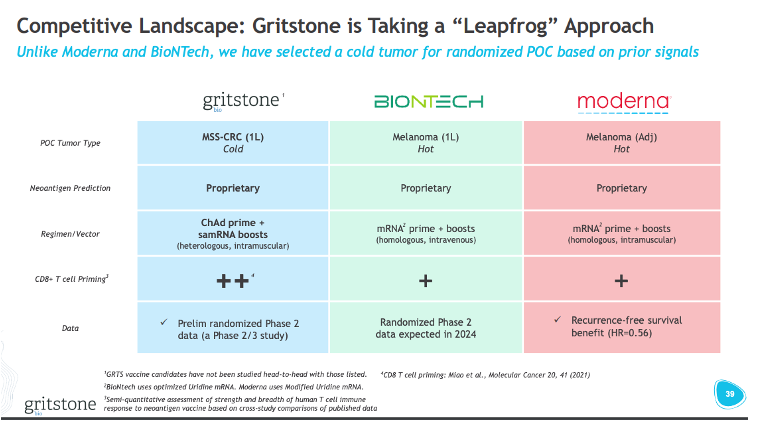

To Gritstone’s credit, they made no bones about going after the path of most-resistance relative to BioNTech and Moderna (see slide above). Based on the issues with the GRANITE development plan: endpoint selection, indication selection, and MOA, do BioNTech and Moderna’s programs have anything to worry about?

The Covid-19 vaccine darlings have both looked to neoantigen cancer vaccines as the next frontier for their mRNA platforms (note: you can learn more about the comparative strategies of these two companies in my previous post), starting with melanoma as the initial testing ground for their expansion into oncology. I think for both vaccine programs, without knowing the nitty gritty behind each of their respective neoantigen prediction models, the limitations I highlighted about Gritstone’s prediction methods likely carries through to both BioNTech and Moderna’s. I think both companies might have designed a development program for their neoantigen vaccines that have higher probabilities of success.

Both companies are targeting adjuvant stage disease as the primary focus of development. BioNTech has one study with BNT122 in 1L melanoma (IMCODE001), but in the company’s presentations, they underscore an initial focus on the adjuvant setting. Moderna has done the same, initially prioritizing the use of its neoantigen vaccine (V940) in P3 studies for resected melanoma, NSCLC, and bladder cancer. Targeting earlier stage disease is important, as this is when the tumor mutational diversity is low, meaning that the neoantigen vaccines (which contain dozens of targets) can have greater target coverage patient-to-patient.

For Moderna, and I would imagine BioNTech follows suit once they reach pivotal stage, the studies will be measuring survival outcomes like RFS, EFS, and DFS, while also likely collecting data on ctDNA. However, since this is in the adjuvant setting, the use case of ctDNA is much better fit, where the investigators can now use it as a measure of assessing relapse, and down the road, potentially using it to rechallenge patients with PD-1 + neoantigen vaccine.

When it comes to tumor type selection, Moderna has clearly prioritized I/O-sensitive tumors first (melanoma, NSLC, and bladder), where tumor mutational burden and T-cell infiltration are typically the highest. Thus, stimulation of more tumor-specific T-cells via the vaccine could help clear remaining tumor cells from the body or create a reservoir of memory T-cells that monitor for recurrent threats. BioNTech is taking a slightly riskier approach, where they are also pursuing cold tumors, but again in the adjuvant setting. Most notably, in pancreatic cancer, where the company reported delayed reoccurrence of disease in a small study of 16 patients. Again, I think this is risky in terms of disease selection, but in this case, the line of therapy may afford an opportunity to generate de novo T-cell responses to a much smaller level of cancerous cell burden, with far less antigen diversity.

In short, I think both Moderna and BioNTech have made better strategic decision in designing their neoantigen vaccine development programs, that avoid or mitigate some of risk-on type choices Gritstone decided to make. That doesn’t mean success is guaranteed. I’m still somewhat neutral on whether neoantigen vaccines will be a major game-changer across cancers, but if they are going to work, I think going after early pre-metastatic stage disease is the optimal time point in the course of disease.

When all is said and done, as more data trickles out from neoantigen players like Moderna and BioNTech over the next year, we'll get a much clearer picture of just how big of a deal this personalized cancer vaccine approach might actually be.