Bayer's Renaissance: A Roadmap for Revival

I examine Bayer's plan to turnaround its sputtering business, highlight my disagreements, and provide my own thoughts on the best path forward.

Hello reader! Your sponsorship could go right here at the very top of the next Big Pharma Sharma post. A sponsored post is 100% accessible to all subscriber levels and gets your brand, product, or service in front of my audience of BioPharma Industry decision-makers. If you or your company is interested in becoming a Big Pharma Sharma sponsor, please reach out to me here or on my socials. Click the button below to learn how you can sponsor the next edition of Big Pharma Sharma.

A Brief History - How Bayer Got Here

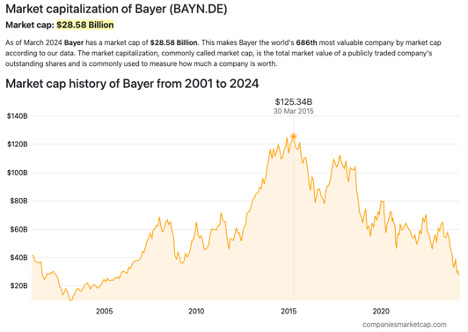

Over its 160+ year history, Bayer has grown through acquisitions into a diversified life sciences conglomerate, spanning pharmaceuticals, consumer health and agriculture. However, its $63 billion purchase of Monsanto in 2018 has saddled Bayer with staggering debt levels and litigation exposure overshadowing its core healthcare businesses. Some are even calling it one of the worst deals ever.

In 2023, Bayer's crop science division had sales of €23.3 billion but an EBITDA margin of just 21.7%, weighed down by Roundup litigation costs. Pharmaceuticals generated €18.1 billion in sales and a 28.7% margin, though its growth was constrained by Xarelto's decline. Consumer health posted €6 billion in sales at a 23.4% margin.

Note: All the slide images are from Bayer’s Capital Markets Day, held on March 5th, 2024. You can hear and see them talk about their turnaround plans in full here.

Bayer's Major Issues

The new CEO Bill Anderson has pointed to a lacking pharmaceutical pipeline, billions in outstanding Roundup litigation, a towering €34.5 billion debt load, and operational inefficiencies across the conglomerate.

While having a diversified portfolio can be valuable, Bayer's disparate businesses face limited synergies beyond being life science companies. This conglomerate structure appears to be imparting a valuation discount overall.

How Bayer Should Prioritize Its Issues and Fix Them

Priority 1: Fix the Bloated Balance Sheet

Bayer's ill-fated $63 billion acquisition of Monsanto has severely levered the company's balance sheet, leaving it saddled with over €34 billion in debt as of 2023. This staggering debt load, taken on primarily to fund the Monsanto deal, has severely constrained Bayer's financial flexibility and cash flows.

A substantial portion of the company's operating cash has been directed towards servicing this debt burden and paying out billions to settle Monsanto's Roundup cancer litigation, rather than being invested into value-accretive growth areas like pharmaceutical R&D. Bayer's options for meaningful deleveraging through organic earnings alone are limited given the ongoing Roundup settlement costs.

In my opinion, the optimal pathway for rapidly restructuring Bayer's unsustainable debt position would be to pursue a full corporate break-up. Separating into three independent public companies focused on pharmaceuticals, consumer health, and crop science/agriculture would allow each business to start with a clean balance sheet apportioned from Bayer's total debt load.