A Few Charts that Outline the Dearth of Innovation in TCR-T Cell Therapies

How much progress has the TCR-T field made in the 15+ years since Adaptimmune first entered the clinic?

February is national cancer prevention month and on the eve of the month, Adaptimmune announced FDA acceptance of its BLA for Afami-cel (MAGE-A4 TCR-T) for synovial sarcoma. Afami-cel’s PDUFA data is set for August 4th, 2024, and if all goes well it will become the first TCR-T cell therapy approved. With this as the backdrop, I was curious to see how the TCR-T pipeline has progressed behind Afami-cel.

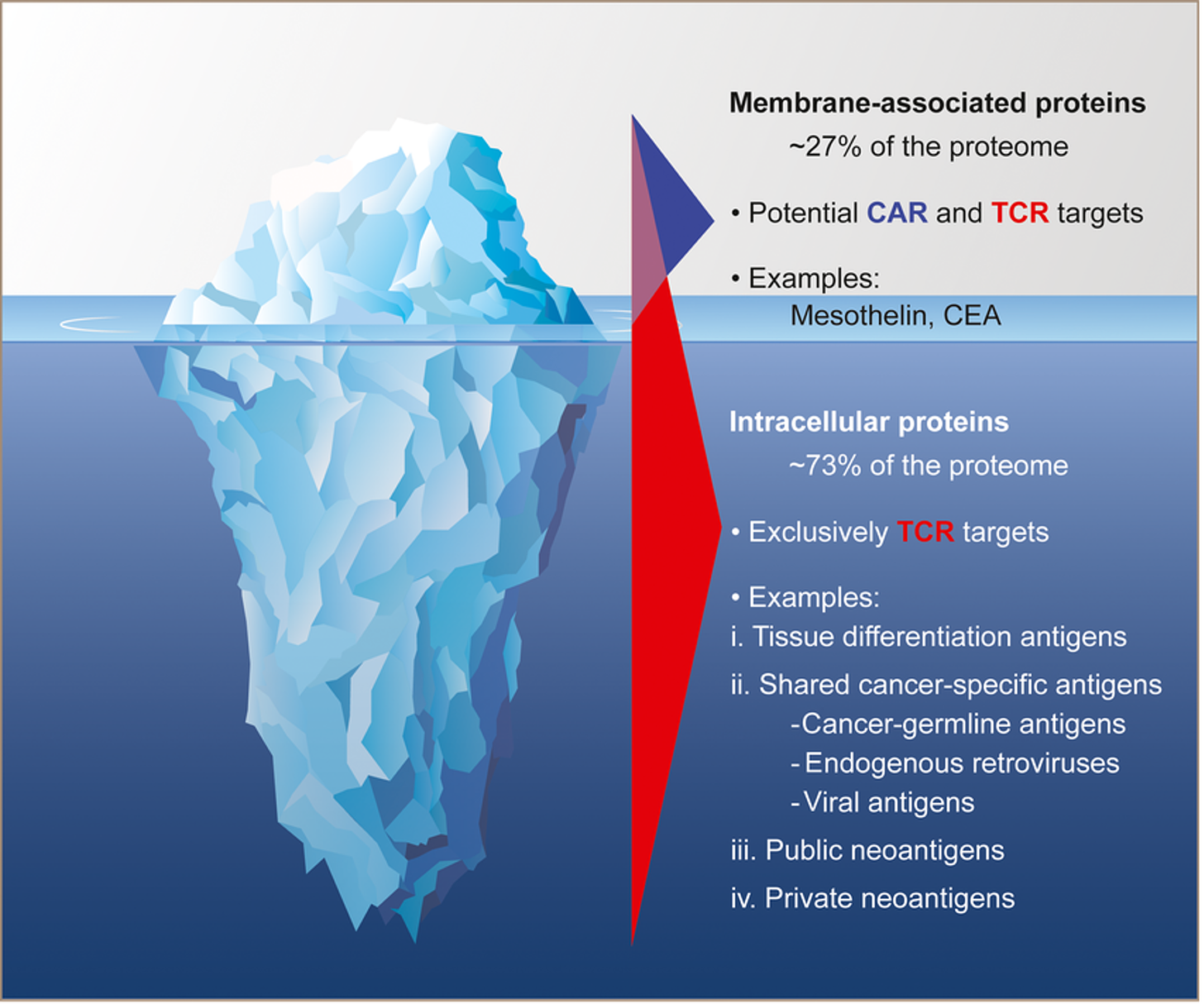

Back in the early innings of cell therapy TCR-Ts were a hot new technology, providing the potential to succeed in solid tumors, where CAR-Ts perhaps could not. TCR-Ts unlocked the deep intracellular target repertoire, which could provide cell therapy developers with a new range of targets that could address solid tumors without the ON-target/OFF-tumor toxicity on healthy tissues driven by CAR-Ts. In the case of Afami-cel, that asset first entered the clinic in August of 2009. That means if its PDUFA date holds true, it will have taken about 15 years for this product to get approved. 15 years is a long time, especially these days where innovations cycles have shortened, synthetic biology tools are advancing readily, and our understand of all the ‘omics’ is unlocking new ways to manipulate cells and discover new targets.

The fact that it has taken this long just to get a TCR-T to the 1-yard line made me think that there must be a plethora of far more innovative approaches ready for approval just over the horizon. Surely other companies have advanced more improved versions of TCR-Ts into clinical studies, ones that would put the first-generation into obsolescence, right? Given the amount of investment in this space (roughly $1.2B raised over the last 5 years from the clinical-stage companies in this space, per data from Hanson Wade’s Beacon Adoptive Cell Therapy Database) we would have surely heard about a next-generation TCR-T, with cytokine modules, cell phenotype control, and/or a whole other suite of bells and whistles rapidly making its way into pivotal studies – but we haven’t.

I hypothesized that the TCR-T space has not innovated very much at all. My guess was that most of the development has been localized amongst a small handful of targets, with few players having multiple clinical stage programs, and even less having truly next-generation cell designs in the clinic. Well, I’m sad to say that based on the data, it appears I’m right.

Before we get to the main body of the post, I wanted to let you know that I'm in the process of sourcing sponsors for future posts in 2024. These posts would be 100% accessible to all subscriber levels and get your brand, product, or service in front of my audience of BioPharma Industry decision-makers. If you or your company is interested in becoming a Big Pharma Sharma sponsor, please reach out to me here or on my socials. You can learn more about sponsored posts on the Sponsored Posts page (link).

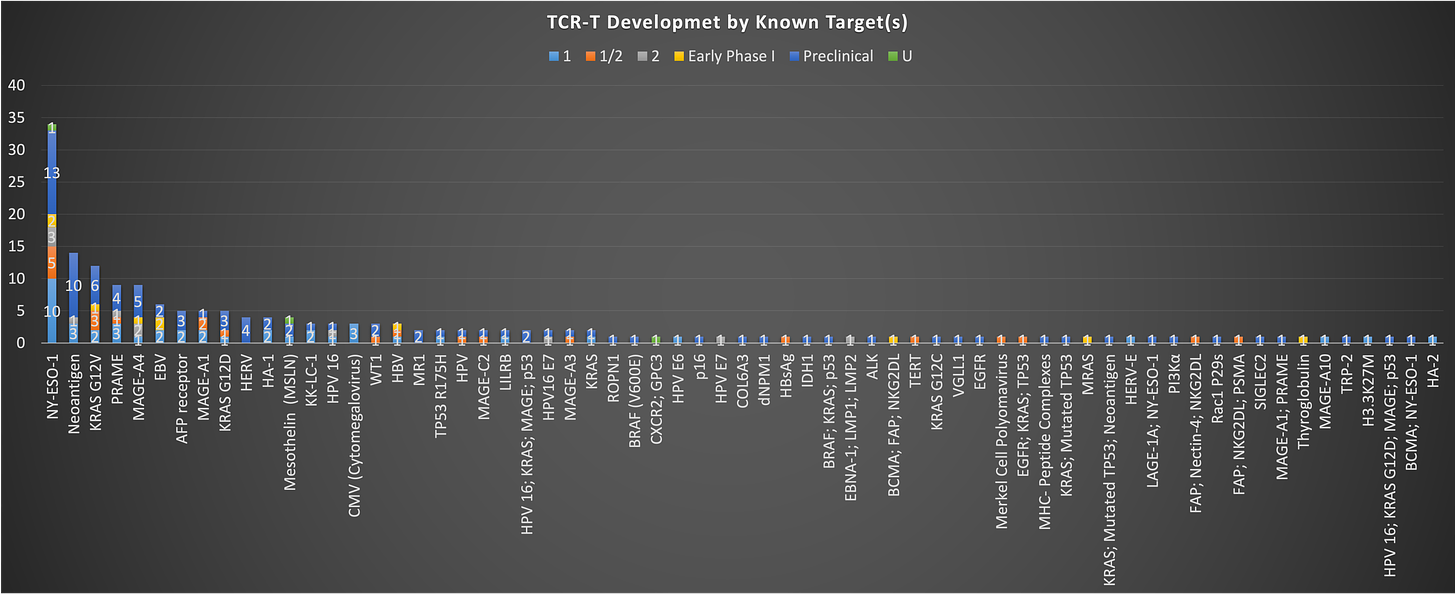

A lot of focus on a few targets

If you take all TCR-T programs and just look at them by target, you see something interesting. There is a ton of density in TCR-T development across a small number of targets. The data reveals just how concentrated TCR-T development has become around a select few well-established targets.

From the chart above, NY-ESO-1 is the most popular target by a mile, with ~34 programs in development going after this antigen. Thus far there aren’t any pivotal programs (as far as I can tell) with product going after NY-ESO-1. It’s been around for a long time, and no one has really put forth an approvable product quit yet. The next most common are neoantigen targeting TCR-Ts, which for my sake, I am going to ignore for now, given that these fit more closely into the TIL/synthetic TIL bucket. After this you see a lot of common names that have also been around for some time: PRAME, MAGE-A4, MAGE-A1, AFP, HPV antigens and the like. A couple newish names to note are the KRAS mutation targeting TCR-Ts. Given the progress made with KRAS G12C inhibitors, you see some activity in this space with programs targeting other mutations of KRAS (G12V/G12D with 12 and 5 programs, respectively), but it remains to be seen how these approaches will fair vs. the small molecule inhibitors that are already likely a step ahead. Exciting new target opportunities like the KRAS mutations are just starting to gain interest despite a deep potential intracellular target pool TCRs were promised to unlock.

This status, with focus on just a small group of targets is similar to what we see in heme/onc with CAR-Ts as well. Without even pulling the data, I can tell you that the overwhelming majority of development is still being focused on CD19, CD20, CD22, and BCMA. Given the lower number of program in TCR-Ts, the situation isn’t as dire as it is in the heme/onc CAR-T world, but could be destined for the same fate, moving ever closer to a hyper-crowded space that has struggled to differentiate from a targeting perspective. I’m hopeful that some of the less pursued targets on this chart show early signs of efficacy that generate more interest away from the same old antigens into new ones.

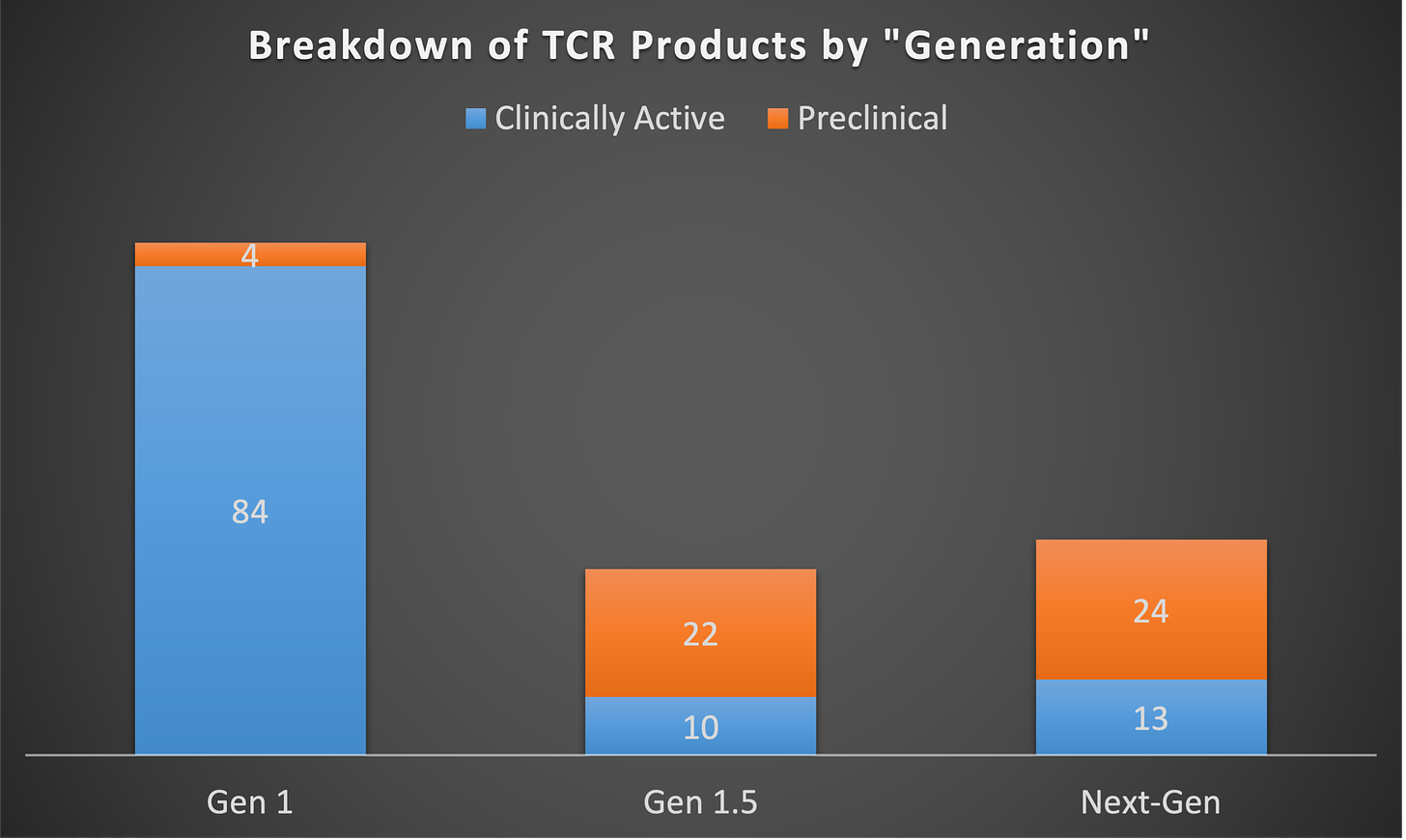

Innovation in cell design has been slow to take hold and not that diverse

So, while the pursuit of targets has been hyper condensed around a select few, we can’t just look at that in a vacuum. How have companies and developers been innovating on other parts of the cell design to enhance the therapeutic profile of TCR-Ts? I went through and categorized each program into one of three groups to roughly characterize the novelty of the cell designs being pursued. (Of note, I couldn’t classify every single product in the database into these three buckets, as many pre-clinical stage assets’ product designs are still unknown or unclear. ) These are noted above as Gen 1, Gen 1.5, and Next-Gen. You can think of Gen 1 as programs that are simply a T-cell with a transgenic TCR targeting a specific antigen, much like the aforementioned afami-cel. Gen1.5 is signified by TCR-Ts which employ some innovations that are not all that new or novel but are certainly guided at improving the product profile beyond simply inserting a new TCR into a T-cell. Examples of this are the common inclusion of a CD8-alpha receptor to boost TCR activation or insertion of multiple TCR targets into one product. Next-gen is pretty much everything else – basically how companies are taking products to the next level. This could include building in checkpoint inhibition, anti-TME elements, co-stimulation, cell phenotype control, or other enhancement modules.

When you look at the landscape through these three lenses, it becomes very clear that despite the time and money invested in this avenue of cell therapy, most of the clinical stage activity is dominated by Gen 1 products. There are strangely more Next-gen approaches in the clinic in comparison to Gen 1.5, which says a lot about how slow the pace of innovation has moved in this space, relative to other cell therapy areas.

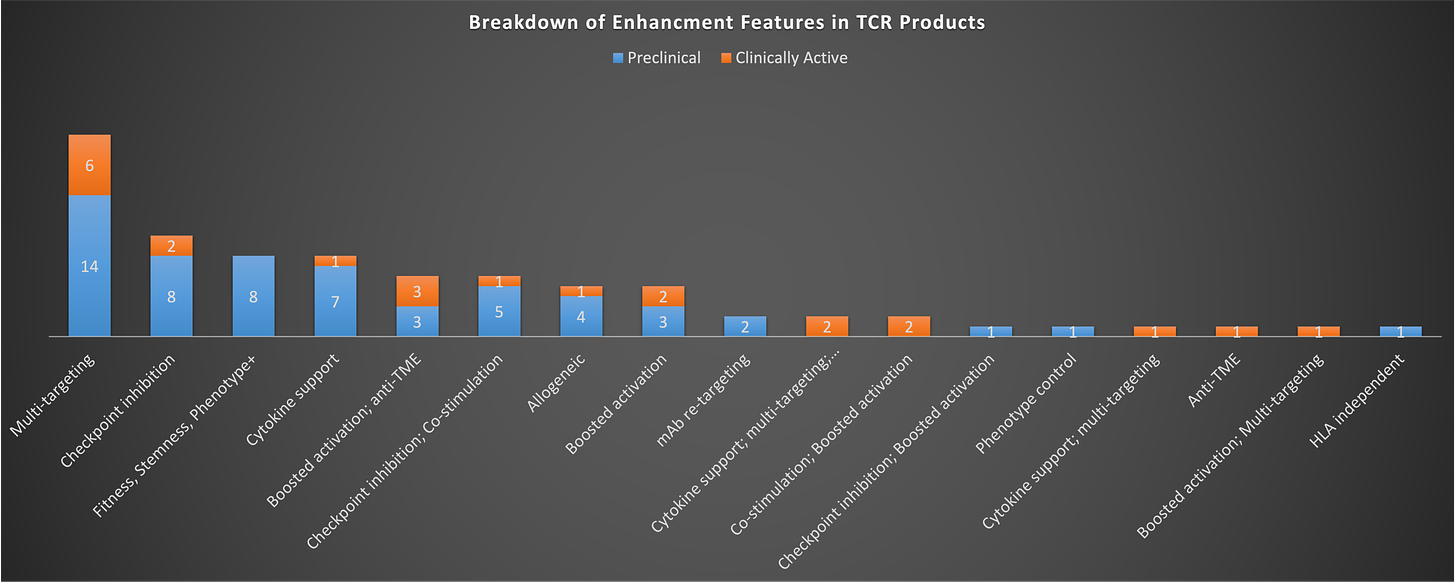

The coming generations are already keeping pace with Gen 1 in some respects, but on other hand, you might think that there should be more programs and types of innovative approaches being tried to quickly supplant a petrifying Gen 1, but that doesn’t seem to be the case either. If you look at what types of enhancements are known to be being pursued, the plurality is focused on multi-targeting, checkpoint inhibition, and/or cytokine support. Checkpoint inhibition is primarily being done via switch/flip receptors (e.g. PD1-41BB), while cytokine enhancement is being pursued largely via inclusion of IL-15, with some instances of other cytokines or chemokines.

Notably, most of the enhancement efforts are pushing on one lever only (i.e. just cytokine enhancement or just checkpoint inhibition). I think we’ve learned enough from our many failures trying to defeat cancer with a cell to know that we probably need to pull more than one of these levers in order drive a meaningful response.

It is surprising just how few next-generation cell engineering designs have reached clinical testing compared to basic TCR-modified T-cells. With over a decade of experience, one would expect to see far more innovative new constructs displacing outdated “Gen 1” therapies. Yet most clinical TCR-Ts remain Gen 1, with minor enhancements like added CD8 components only slightly ahead of truly novel multi-modal designs.

Conclusion

So even with the first approval imminent, the last 15+ years of TCR-T research have seemingly produced little innovation. While afami-cel's success could catalyze new discovery and engineering efforts, the field appears overdue for renewed thinking regardless.

Moving forward requires expanding beyond well-trodden targets and single modification approaches. Computational tools offer new target discovery potential, but multi-pronged cell engineering is critical to drive meaningful patient benefit. Tackling patient selection complexities around target expression, HLA-typing, and fitness is also imperative.

In conclusion, the TCR-T field looks stagnated despite afami-cel's progress. With expanded target discovery, multi-modal cell engineering, and patient selection refinements, TCR-Ts still hold promise. But renewed innovation is needed to realize their full potential - with or without regulatory approval sparking change. That being said, I am hopeful that the new players who have based their entire company on TCR-Ts, like Tscan and Affini-T see early success in the clinic, and Adaptimmune’s initial approval gets over the finish line without any roadblocks. Perhaps a “win” in this space will reignite the spark of innovation in this field once more leading to new breakthroughs.