Big Pharma Sharma's Bullets: Implications from a Few Major News Items this Week

Below I discuss my thoughts and insights regarding a few major news items this week, including CRISPR’s pipeline cuts, Roche entering GLP-1, and Replimune’s failure in CSCC.

Introduction

This week was full of interesting strategic maneuvers and important catalysts from biotech players. I wanted to take the time to discuss a few of these this week and tease out some potential implications that we should have our eye on for the future.

CRISPR Therapeutics Cuts Lead CAR-T Programs

In somewhat of a surprise, CRISPR therapeutics announced that it would be shutting down its lead healthy-donor allogeneic CAR-T programs, CTX110 (CD19 CAR-T) and CTX130 (CD70 CAR-T), opting to pivot to next-generation versions of both products (dubbed CTX112 and CTX131, respectively) that employ additional edits to enhance efficacy. Specifically, both programs knockout Regnase-1 (increase anti-tumor response and inflammation) and TGFBR2 (resistance to TGF-beta in the TME). CRISPR also noted it would be joining the already growing field of CD19 CAR-T therapies in autoimmune disease, by developing in CTX112 in autoimmune indications (see my previous post on this landscape), as well as heme/onc. A trial in SLE is targeted for 1H’24.

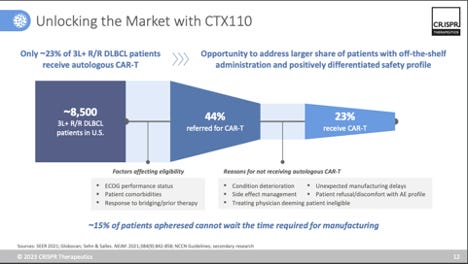

While company spin notes that CTX110 and CTX130 were “proof of concept” programs, the reality is that CRISPR would have opted to further develop these programs in pivotal studies, if they felt they had a competitive profile. In their Q1’23 investor presentation they include a slide on “unlocking the market with CTX110” (see image above), so clearly, they had commercial aspirations for this product. But when faced with data that didn’t meet the competitive bar ( e.g. 6-month CR rates in the 19-23% range) set by autologous CAR-T, it wasn’t worth further investing. And look, overall, that is a good thing. It isn’t worth investing in programs that aren’t going to be competitive. Especially for cell therapy development, being able to test in the clinic and pivot quickly to next-generation programs that offer the shot at a better product profile is vital. It’s a smart move by CRISPR, and unlike other allo’ companies, they are uniquely positioned to scuttle two lead programs in favor of 2nd-generation programs that offer a brighter day. Why is it easier for them to do this? Well, first off, they are extremely well capitalized (~$1.74B as of Q3’23), which is unlike most biotech companies right now. And secondly, they (along with their partner Vertex) are on the verge of a landmark US approval for CASGEVY (exa-cel, PDUFA December 8th, 2023), a potential curative treatment for sickle cell disease and other hemoglobinopathies. CASGEVY is projected to be a breakthrough blockbuster, with CRISPR therapeutics set to record 40% of profits on CASGEVY sales. Having lots of capital means you also have a lot of time, and CRISPR is well positioned to take its time entering the allo’ space once it feels it has a best-in-class product offering.