Intro

It is surprising how quickly SITC has come on the heels of ESMO this year. I’m still in the process of digesting all the interesting findings that came out of ESMO, but here SITC is ready to get going and start dropping data. I’m used to these two important oncology conferences being spread much further apart, so the spacing of these conferences feels like an anomaly. ASH abstracts have also been released, making for a tidal wave of new oncology today to wrap my head around before the end of the year – I guess I need to learn how to surf.

For today’s post I’m going to be flagging a few winners from ESMO, before I switch to reviewing the plethora of ASH abstracts and monitoring for any major breakthroughs coming out of SITC.

Without further ado, let’s get into it.

ESMO Winners

#1: ADCs

ESMO featured data from several ADCs that stole the show at the conference. We also saw a couple ADC deals from Big Pharma players announced proximal to the conference.

Padcev + Keytruda in 1L Bladder Cancer

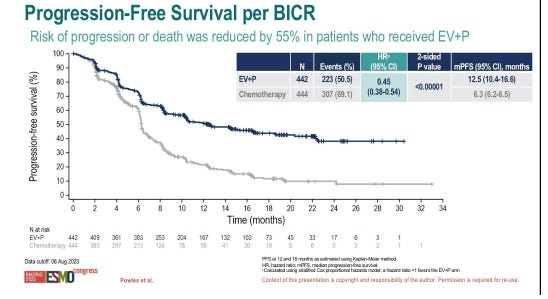

Pfizer/Seagen and Astellas reported data from its P3 EV-302 study of Padcev (nectin-4 ADC) + Keytruda (PD-1 mAb) vs. chemotherapy in frontline urothelial carcinoma (both cisplatin eligible and ineligible patients). The data was met with a standing ovation in the presentation hall, and rightfully so. The chemo-free combination demonstrated a 68% ORR and 29% CR rate (vs. 44% and 13% for chemo) and significantly prolonged mPFS (12.5 mo vs. 6.3mo; HR:0.45) as well as mOS (31.5 mo vs. 16.1 mo; HR: 0.47). Efficacy did not vary based on cisplatin eligibility either.

Anytime you see hazard ratios below 0.50 (i.e. a >50% risk reduction) in Oncology are hard to come by and it seems Pfizer/Seagen and Astellas hit a homerun with these data. Recall, this combination has accelerated approval for patients with frontline bladder cancer who are cisplatin-ineligible and will likely serve as confirmatory approval for this indication plus expand use of this combo into cisplatin-eligible patients in the 1L setting as well. This will go a long way towards Pfizer’s ROI on its massive buyout of Seagen (still yet to be closed), and also puts distance between Pfizer/Seagen and BMS, whose Opdivo + chemo combination in 1L cisplatin eligible bladder cancer only generated mPFS and mOS of 28% and 22%, respectively.

ADC Deals

The big BD&L news around ESMO was Merck announcing a massive ADC collaboration with Daiichi, paying $5.5B ($4B upfront + $1.5B in continuation payments) upfront and up to $22B in biobucks to Daiichi to co-develop and co-commercialize three clinical stage ADCS: patritumab deruxtecan (HER3-DXd, HER3 ADC in pivotal for mEGFR NSCLC), ifinatamab deruxtecan (I-DXd, B7-H3 ADC in P2) and raludotatug deruxtecan (R-DXd, CDH6 ADC in P2).