ASCO 2024 Temperature Check - Part 2

Below is part two of my ASCO preview, where I examine whose temperature has run cold and tepid coming out of data presented at the premier annual Oncology conference

This edition of Big Pharma Sharma is brought to you by OUTKREATE

Engage and Influence Audiences with Expert Presentation Design and Storytelling

OUTKREATE partners with executives at large companies to develop high-stakes presentations, enhancing both the narrative and design to drive impactful business results.

Trusted by Investor Relations, Sales, Marketing and Corp Comm teams, we enable our clients to influence stakeholders across investors, customers, C-suite, and employees.

Our select clients include Gilead, GoodRx, Nestle, Hershey, Mondelez, Hasbro, and Northrop Grumman.

Discover how we can elevate your presentations and impact your business. Visit www.outkreate.com.

Talk to Outkreate’s experts about a specific presentation you’re working on and walk away with actionable insights in a no-pressure setting

In case you missed part one of my ASCO temperature check, you can find it here (for subscribers). As you can see from the above, part two is sponsored by the great folks at Outkreate, and thus open/unlocked for all subscription levels.

I met Outkreate’s CEO, Harry Shah, during my time at Gilead and found his dedication to compelling visual-based storytelling and client service to be of the highest quality. I could not be happier that Outkreate is Big Pharma Sharma’s first sponsor. If you are a strategy professional or IR professional, I would encourage you to take Harry up on his no-obligation consultation offer and see how Outkreate can take your presentation game to the next level.

Without further ado, let’s get into part two!

🌡️Tepid: Katy Perry, Hot N Cold

TIL + PD-1 in 1L melanoma: interesting data, but a high bar to clear, and more competition on the way

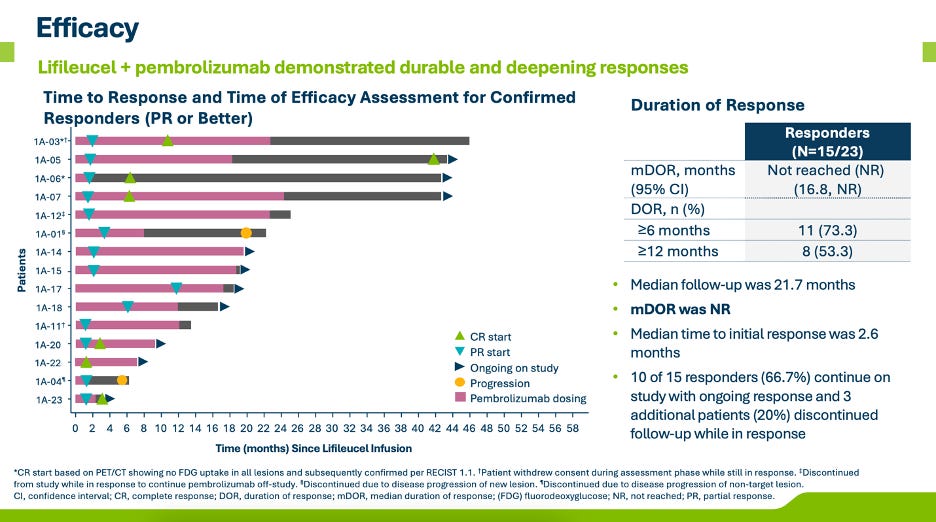

Iovance presented updated P1/2 data from its IOV-COM-202 study, specifically from the TIL+PD-1 cohort in frontline melanoma. These data provide proof of concept and early read through to the potential TPP for AMTAGVI + PD-1 in 1L melanoma, currently being studied in AMTAGVI’s confirmatory P3 TILVANCE study vs. PD-1 monotherapy. Overall, the combination showed a 65% ORR (30% CR) in 23 patients with a median DOR not reached at a median follow-up of ~22 months. Notably, the patients who ended up relapsing on-study were those who stopped PD-1 treatment early. For a few of the patients who remain on PD-1 therapy, it will be interesting to see if these PRs deepen enough to become CRs over time.

These data look good for the approvability of the forthcoming P3 TILVANCE study. In comparison, KEYTRUDA monotherapy registered a 42% ORR (14% CR) and mPFS of 9.4 months in the KEYNOTE-006 study. Given TILVANCE’s co-primary endpoints are ORR and PFS the higher ORR and CR increase confidence that TIL+PD-1 will result in superiority on at least one of the co-primary endpoints. Iovance has stated they expect to readout on ORR in ~3 years and PFS in ~4 years. Even if you price-in some modest (and likely) drop in ORR/CR with increased study size, I could easily see the TIL+PD-1 responses net out in the 55%+ ORR and 25%+ CR range.

While these data bode well for approval, I’m not so sure it bodes well for uptake in the frontline setting. The bar in frontline melanoma is high, and perhaps getting higher. My suspicion is that treatment decision-makers and payers will want to see OS data before any real significant use of TIL+PD-1 in the frontline setting takes off. Moreover, I think discerning eyes will feel as though the PD-1 monotherapy comparator arm isn’t a fair comparison for the typical TIL patient, who is more likely to be younger, fitter, and better-suited for more aggressive treatment in the earlier line setting. To me, docs will be deciding between TIL+PD-1 or putting a patient on OPDIVO + YERVOY, which per the Checkmate-067 study, has demonstrated a 58% ORR (19% CR) (not all that different from where I think TILVANCE ORR/CR could end up), 11.5-month mPFS, and a mOS of 72 months. TILVANCE will need to clear 72 months by a fair margin, especially for a more logistically complex, expensive, time-consuming, and less-available therapy. Only time will tell whether TIL+PD-1 has the necessary horsepower to clear this bar, but if we aren’t getting a PFS readout for another 4-years, we will likely be waiting quite a long time for a definitive OS read out.

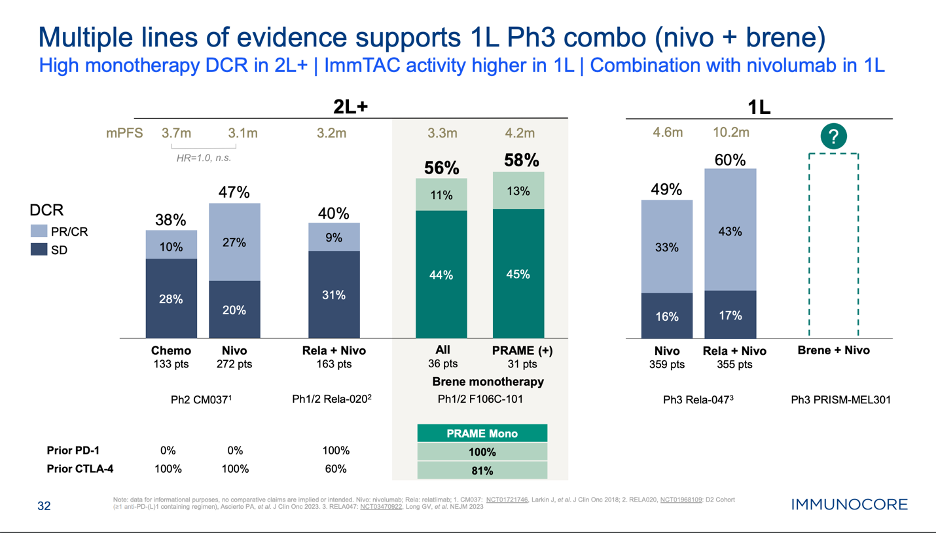

Melanoma is heating up in general. We also saw Immunocore provide a first look into monotherapy data of its second product, called brenetafusp (PRAMExCD3 TCR Bispecific), in 2L+ melanoma, as well as Replimune present the primary analysis of its P2 IGNYTE study of RP1 (oncolytic virus) + nivolumab in 2L+ melanoma.

Starting with brenetafusp, while on the surface, the data do not strike you as impressive (i.e. only a 10% ORR in this 2L+ population), Immunocore made the case that the disease control relate and ctDNA response of their unique MOA is the best predictor of PFS and OS outcomes, stemming from their experience with KIMMTRAK in uveal melanoma. Brenetafusp seemed to show an early PFS and OS benefit in PRAME+ vs. PRAME- patients. The end goal here for Immunocore is to take this product into a randomized P3 study in combo with nivolumab in the frontline setting, vs. nivo monotherapy and OPDUALAG. Given the high expression of PRAME on melanoma, Immunocore isn’t doing any prospective PRAME screening, and thus could get a label that doesn’t require prior PRAME testing in this setting, assuming the data justify this. Furthermore, the P3 study has primary completion date of December 2026 with a PFS primary endpoint. It’s conceivable that Immunocore sees greater benefit in a PD-1 naïve population (compared to the 2L+ data we saw at ASCO), in a study with a more relevant comparator (I/O combo) and achieves primary data readout ahead of TILVANCE altogether, putting Iovance and AMTAGVI further behind the eight ball. There is a scenario here where brenetefusp + nivo is approved in 1L melanoma before TIL+PD-1 and with data from a more clinically relevant/stronger comparator, thus engendering more confidence in the therapeutic benefit being seen.

Replimune, who I’ve discussed before, also presented very interesting potentially pivotal data that could cause Iovance and AMTAGVI some trouble, specifically in the 2L+ melanoma setting. RP1 + nivolumab registered a ~34% ORR in 2L+ melanoma with mDOR not reached at >35 months and importantly showed responses both in injected and un-injected lesions. This is key, as the primary negative stigma surrounding the oncolytic viruses has largely been the inability to trigger systemic responses from local treatment (i.e. the abscopal effect). The company has plans to initiate a confirmatory randomized P3 study before BLA submission in patients who have failed PD-1+CTLA-4 or at least PD-1 if they are not candidates for CTLA-4. Notably, this post PD-1+CTLA-4 patient population is again an approximation of the ideal TIL patient. In a world where off the shelf RP1 + nivo is approved, I can envision community docs wanting to try this combination ahead of referring their patients to an ATC for TIL therapy, potentially shrinking the total addressable market for AMTAGVI in the 2L+ melanoma setting.

Long-story short: melanoma is feeling like a tougher place for AMTAGVI to play, with 1L SoC already setting a high bar and 2L+ treatment post PD-1 failure making way for new entrants with nominally similar efficacy without the time, cost, and logistical complexity that comes with TILs.

KRAS G12C combos: KRAZATI meets the mark, but the next-gen wave is heating up with combo data looking very promising

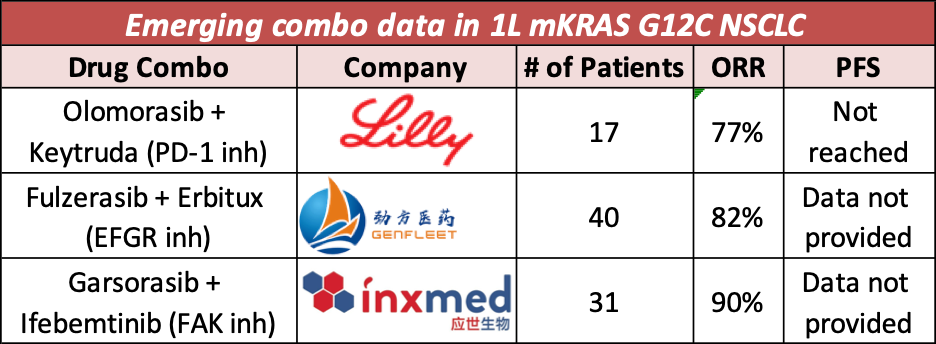

A quick note on KRAS G12C inhibitor data, which caught my eye. While most of the attention in this space at ASCO was focused on BMS’ KRAZATI presenting its pivotal P3 KRYSTAL-12 data set in 2L+ NSCLC (+1.7 mo PFS benefit, HR: 0.58, and not all that different from the 1.1 mo benefit Amgen showed with LUMAKRAS in the same setting), giving KRAZATI a leg up over rival LUMAKRAS (Amgen), it was early stage combo data from the next-wave of KRAS G12C inhibitors that gave a glimpse into the future of how this MOA can be optimized in the treatment of lung cancer.

Lilly, Genfleet, and Inxmed presented three different types of combinations with their own KRAS G12C inhibitors, showcasing very high ORRs in early data, ranging from 77-90%. This new wave of KRAS G12C inhibitors, with iterative chemical improvements over the first-gen versions (LUMAKRAS and KRAZATI) that seem to be translating into efficacy improvements. Similar combo data of LUMAKRAS and KRAZATI in 1L NSCLC in combo with PD-1 have shown responses in the ~50-60% range. Lilly’s purchase of Loxo continues to look better over time and perhaps they could supplant Amgen and BMS as a late comer to this KRAS G12C arena. Notably, olomorasib is in a larger P3 study in combo with PD-1+chemo in 1L NSCLC.

This whole space feels very dynamic to me. LUMAKRAS and KRAZATI have not been on market all that long, and given the early regulatory struggles they’ve faced, specifically with LUMAKRAS, there seems to be room for follow-on players to supersede these early entrants with better data and a more aggressive clinical trial plan.

🥶Cold: Major Lazer (feat. Justine Bieber), Cold Water

TROP2 ADCs in NSCLC: 2L+ data has fallen flat, so maybe it’s 1L or bust?

What is there left to say about TROP2 ADCs for NSCLC? While this MOA has shown to be a new part of the SoC in breast cancer, the challenges continue to mount as to where else this target is relevant. Headed into ASCO, where we awaited Gilead’s presentation of the failed P3 EVOKE-01 study in 2L+ NSCLC, we learned that Gilead also reported failure of the P3 TROPICs-04 study in patients with bladder cancer previously treated with PD-1 + chemo, putting TRODELVY’s accelerated approval in bladder cancer in jeopardy. Things just keep getting worse for TRODELVY, and in retrospect, Gilead’s $20B+ acquisition of Immunomedics. TRODELVY’s market share in HER2-/HR+ and triple-negative breast cancer is likely to get pinched by ENHERTU’s expanding HER-2 low/ultra-low strategy, while entrants like Merck/Kelun’s Sac-TMT may offer a better safety/efficacy profile in TNBC as well.

Switching to Lung cancer though, it’s hard for me to make heads or tails of what role TROP2 ADCs can play in this setting coming out of ASCO. EVOKE-01, which we knew was going to be negative, seemed to indicate that TRODELVY (SG) showed a benefit in a sub-population of patients who achieved a best response of SD or PD on prior PD-(L)1 treatment. On the flip side, SG did not show any differential benefit in non-squamous vs. squamous histologies, which was the opposite or AstraZeneca/Daiichi’s Dato-DXd in Tropion-Lung-01. Some have theorized that Dato-DXd showing benefit only in the non-squamous population is due to that studies enrollment being heavily weighted towards that patient population, which typically sees better outcomes than squamous histologies. Tropion-Lung-01 also had patients with driver mutations, where TROP2 ADCs have shown to be beneficial, perhaps giving Dato-DXd a leg up on SG from a study design perspective.

Gilead could look to run a new study strictly in this PD-1 non-responder patient population, but that seems like a rather risky proposition, unless you have a detailed understand of the underlying biology that’s driving this sub-group specific benefit. Internally, they probably feel like if they ran SG in the exact same population as Dato-DXd, EVOKE-01 would have been positive, and Gilead would be close behind AstraZeneca and Daiichi in filing SG for approval in 2L/3L+ non-squamous NSCLC patients. My intuition is that if very narrow differences in population were the make-or-break factors in the study being positive or negative, then neither drug is likely to be all that effective in this setting. Surely Dato-DXd will get use in 2L/3L+ NSCLC, given the dearth of available options, but it seems like its set to win approval on a technicality and should not be considered a major threat to other products looking to show efficacy in the post-PD-1 setting.

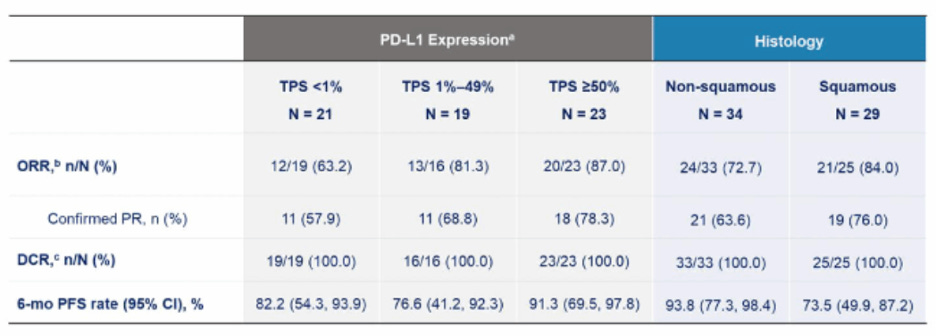

So that just leaves TROP2 ADCs with 1L NSCLC in combo with PD-1 ± chemotherapy. Every new mechanism of action that aims to go after post-PD-1 lung cancer seemingly finds itself pivoting to the 1L setting in combination, and perhaps for TROP2 ADCs, that’s where they will find an easier path to success. Data from Merck’s Sac-TMT in combination with a PD-L1 antibody, presented at the conference, showed high ORRs across subsets (with caveats for it being Chinese data and early follow-up): 63% in PD-L1- patients , 81% in PD-L1 low, and 87% in PD-L1 high patients. This dataset compares favorably to SG’s combination in EVOKE-02 which showed a 67% ORR (only in PD-L1 hi patients) and Dato-DXd which showed 44%/34% in PD-L1- (without and with chem), 47%/74% in PD-L1 low, and 100%/53% in PD-L1 high in Tropion-Lung02 (with caveats for small patient numbers in each subgroup).

The data in 1L NSCLC are still early and need longer follow-up, but it’s looking more and more like if TROP2 ADCs are to add benefit for patients in NSCLC, it will need to be in the highly competitive 1L setting.

Caribou’s Allo’ CD19 CAR-T: HLA rhymes with delay

Finally, for the last one in the cold category, let’s take a quick look at the new data Caribou presented at ASCO, studying their lead program CB-010 (healthy donor allo’ CD19 CAR-T with PD-1 KO) in R/R NHL. If you follow this company, you know that they are aiming to transition CB-010 into a pivotal P3 study in 2L LBCL vs. auto’ transplant (ASCT). Even before getting into the new data presented, there are a clear set of challenges and oddities in how they are advancing this program. Running a P3 study vs. ASCT in a world where CD19 CAR-T has already shown superiority to this SoC and is commercially approved for this use case, would conceivably pose some recruitment challenges for this P3 study. Additionally, knocking out PD-1 in this product and claiming there is an enhanced efficacy benefit is a stretch, given analogous data from CD19 CAR-Ts in combination with PD-(L)1 based therapies has not shown a differential efficacy benefit in the clinic.

The crux of the new data they shared at ASCO highlighted a correlation between HLA-matching and efficacy. Specifically, those patients who had a match of at least 4 HLA-alleles (i.e. partial-matches) seemed to show a PFS benefit compared to subgroups with lower levels of HLA matching. The 4+ HLA matched subgroup showed a mPFS of 14.4 months with a CR rate of 46%. If you just look at the LBCL patients who were 4+ (n=11) the ORR was 91% (36% CR) with 6-month PFS of 53%. For reference, YESCARTA in ZUMA-7 registered an ORR of 83% (65% CR), mPFS of 14.7 months, and 4-year PFS rate of 42%.

So, on the one hand, this is solid translational work, finding a threshold of HLA matching that correlates with longer-term efficacy. On the other hand, this pivot to a partial HLA matching strategy result in a delay in potential approval (most notably) and a meaningfully different business model than what the off-the-shelf promise of healthy donor allo’ CAR-T once held.

Caribou’s rationale here is obviously that going with a partial HLA match approach, ensures that product going into patients has the necessary persistence and expansion capacity needed to derive the long-term efficacy and malignant B-cell clearance needed for sustained (potentially curative) efficacy. More importantly, what they are telling their stakeholders is that this pivot to HLA-matching and potential persistence benefit is worth a 6mo+ delay in the start of its pivotal P3 study. They are looking at a ~3yr study, so 3.5 years from now we will be in late 2027. Making standard assumptions for filing and FDA review, Caribou can’t be expecting CB-010 to get approved any earlier than Q3’28.

From a business model perspective, CB-010 patients would need to be screened for HLA typing and Caribou would need to store multiple (~13) different batches of product to cover ~90% of the target 2L patient population. While this may not affect the time to treatment, it does complicate the underlying COGS and sourcing for this version of healthy donor allo’. Caribou now needs a steady supply from multiple donors with different HLA profiles.

All-in-all, I think this is nearing the last straw for CB-010 and is quite a big gamble. I don’t think there are more pivots left in their bag. This HLA matching strategy kind of must work, for the program to be commercially viable in LBCL. Their previous pivot to autoimmune diseases kind of gives the product an out overall, but at least for the sake of its future in heme/onc, it’s now or never. They’ll be entering a market where auto CAR-T is the established entity with multiple years of curative efficacy and safety data behind it, building out a business model centered on HLA-matching, based on all of five patients’ worth of data at the recommended phase 2 dose in LBCL.

Wrap-up

That’s it for my ASCO review. I hope you enjoyed both part one and part two. I’ll catch you all next week with more BPS content. In the meantime, since this post is fully unlocked for all subscribers, I would appreciate sharing this with your socials to extend the reach of my work. Thank you once again to Harry and the team at Outkreate for sponsoring this post.

Until next time, BPS out.