ANALYZING BMS’ ACQUISITION OF MIRATI

Did BMS overpay? How did missteps with Lumakras play into this deal? How does Mirati fit into BMS larger ambitions? What does this deal foretell for other Big Pharma players?

Did BMS Overpay or did they get a Good Deal?

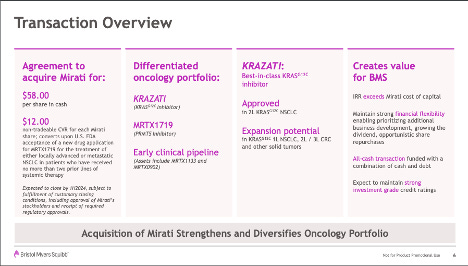

In all honesty, I was planning on writing about Mirati (MRTX) for my “Biotech Buyouts” series this week, after we learned that its closest competitor, Amgen’s LUMAKRAS (sotorasib, KRAS G12C inh), received a negative ODAC vote for its confirmatory phase 3 CodeBreak 200 study in mKRAS G12C patients with 2L+ NSCLC. This vote also occurred in the wake of rumors that Sanofi was nearing a takeout of Mirati. However, BMS beat me (and perhaps Sanofi) to the punch, announcing on Sunday that they agreed to acquire Mirati for $4.8B at a ~52% premium. The deal includes a contingent value right (CVR) valued at ~$1B dependent on FDA acceptance of a NDA for MRTX1719 (PRMT5/MTA inh) in 3L NSCLC.

Comparing the $4.8B takeout price and $52% premium to similar deals as of late, it appears despite a clearly competitive bidding process, BMS paid a fair price for Mirati. Looking at my M&A database, the predominance of acquisitions this year in the $2B-$10B have averaged a $48% premium, so the $52% feels on-market to me, despite the other deals in this range being non-oncology focused. For context, In June 2022, when BMS acquired Turning Point Therapeutics, its first foray into targeted oncology, it paid a 122% premium at $4.1B valuation. Back around that time, Mirati was valued at about ~$2.5B market cap. At its highest point, in December 2020, Mirati was valued at ~$12B.