Amazon Should Buy a Generic Drug Manufacturer

Why Amazon’s potential entry into the generic drug business could massively disrupt healthcare

Executive Summary

Amazon has made major strategic bets in specific parts of the healthcare value chain over the past several years, with deals like PillPack (now Amazon Pharmacy), Haven (now defunct) and OneMedical as signature plays to enter into Pharmacy, Insurance, and Primary Care businesses, respectively. Amazon has demonstrated their ability to dominate in retail, supply chain & logistics, and by acquiring a generic drug manufacturer for a relatively small sum, the company could make a low-risk/high-reward bet that could realize the immense potential of their pharmacy business and further establish Amazon as a disruptive threat to the larger healthcare ecosystem. Moreover, selling generic drugs, aligns closely with what Amazon has already proven to do quite well in other arenas: leveraging its core capabilities to deliver existing products in a more customer-focused, logistically streamlined, and cost effecient manner.

Background

Amazon is a, or rather the, major player in the retail and e-commerce sector, however the company has historically targeted Healthcare as a major growth area. Over the last several years, Amazon has acquired or launched new business units aimed at capturing different aspects of the healthcare value chain. They’ve made major bets in telehealth, primary care, pharmacy, insurance, and health tech. The success and failure of these strategic bets has been mixed, but this pattern of corporate behavior clearly indicates a deep interest in leveraging the company’s core competencies to disrupt multiple aspects of the healthcare value chain. Table 1 below highlights some of Amazon’s major bets in more detail.

Amazon as a Generic Drug Manufacturer - How It Could Work

Generic (and biosimilar) drugs encompass the overwhelming majority of all drug prescriptions, approximately 9 out of every 10 prescriptions in the US, according to the FDA.

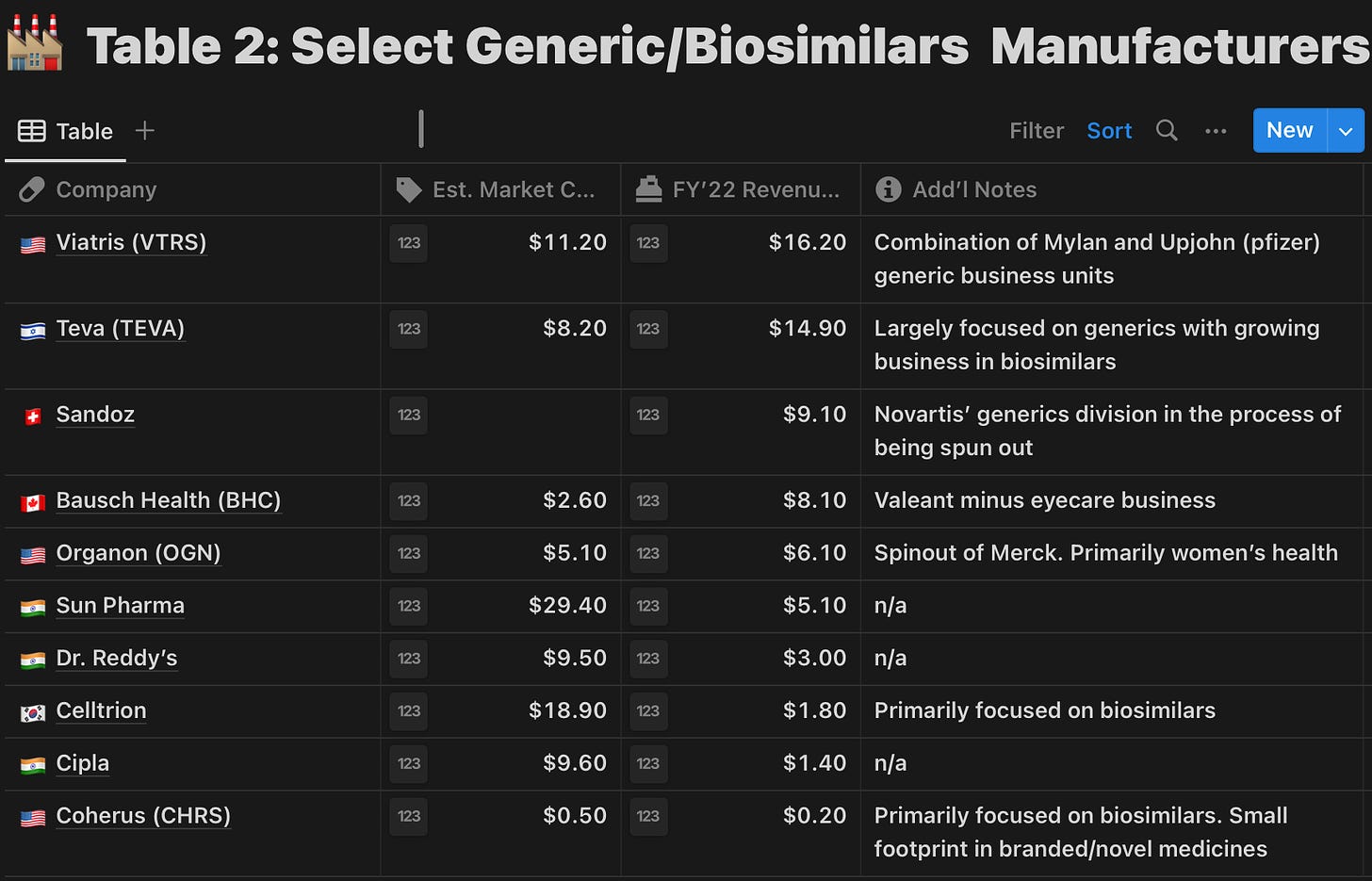

For a company the size of Amazon, acquiring a generic drug manufacturer would require a relatively low capital outlay. Per its Q3’23 earnings report, Amazon has ~$64B in liquidity, which dwarfs the market caps of pretty much any major generics company (see Table 2), enabling it to enter into the generics space with an all-cash offer.

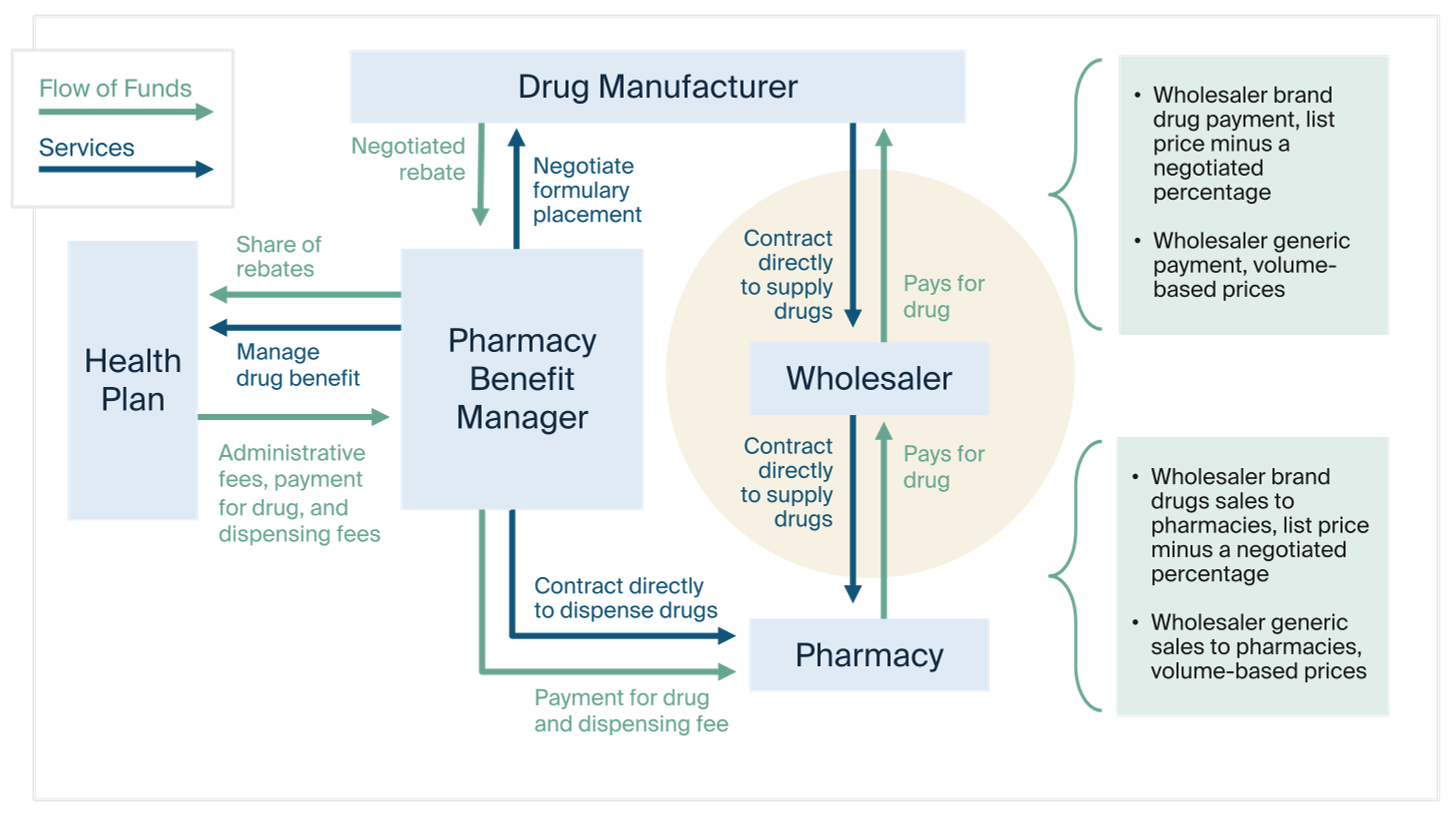

Amazon has a strong brand, a large customer base, best-in-class logistics, and a vast distribution network. Owning a generic/biosimilar drug manufacturer would allow them to vertically integrate the supply chain and directly distribute to Amazon customers via Amazon Pharmacy. This would allow Amazon to largely subvert drug wholesalers, lower the cost of generic drugs, and improve access to these medications for consumers.

Source: Elizabeth Seeley, The Impact of Pharmaceutical Wholesalers on U.S. Drug Spending (Commonwealth Fund, July 2022). https://doi.org/10.26099/6qtd-k783

The consolidation of retail pharmacy with generic drug manufacturing could offer Amazon more negotiating power with PBMs, resulting in downward pricing pressure, reduced rebates for PBMs, and additional savings passed onto customers. Even without insurance, Amazon may be able to go around PBMs and insurance plans to great degree by offering lower out-of-pocket costs to patients for a wide array of medicines compared to what patients would otherwise pay with copays and deductibles. This is already the case for many patients using Amazon Pharmacy as it currently stands. Speaking from personal experience, a prescription I needed to fill recently was ~$30 with insurance at my local CVS. After transferring my prescription to Amazon, my prescription cost ~$7 without insurance. That is a much better deal even before considering the fact that it was delivered to my doorstep within 2 days all with couple taps from my smart phone.

Buying a generic/biosimilars player and bringing in a massive portfolio of high-use medicines could enable Amazon to follow the same business model as Mark Cuban’s Cost Plus Drugs Company (MCCPDC), but execute it at unparalleled scale. MCCPDC has been taking the internet by storm, with patients all over the country noting massive reductions in out-of-pocket costs for medicines they need in order to manage chronic conditions. MCCPDC operates on a simple business model: it buys generic drugs directly from manufacturers, cuts out the middlemen, and passes the savings on to customers. The company charges a 15% markup on the cost of the drug, plus a dispensing fee. There are no hidden fees or surcharges.

Some may feel like Amazon getting into the drug business is a bridge too far, but given there existing footprint in the healthcare space, this acquisition would enable the company to control more parts of care delivery. Ultimately, manufacturing lower cost versions of existing products is already in Amazon’s corporate DNA. The plethora of Amazon Brand toilet paper, vitamins, cleaning products, clothing, and other items are a result of this behavior. Generic drugs fit the same structure. Amazon wouldn’t be innovating new medicines, they would be taking medicines that are already proven to work and leveraging its core capabilities to deliver them in a more customer-focused, logistically streamlined, and cost effecient manner. Amazon has proven time and time again that it is excellent at selling and delivering other people’s products simpler, faster, and cheaper.

Potential Benefits to Amazon

There are many reasons why Amazon would do this sort of deal:

New revenue streams. Amazon could generate new revenue streams from the sale of generic drugs, as well as from the sale of related products and services.

Improved margins in Pharmacy and Clinic business: vertical integration of the supply chain would bring down costs for Amazon Pharmacy and Clinic and enable it to offer even lower prices to consumers to capture market share.

Distribution network and portfolio leverage. Amazon's vast distribution network would allow it to reach a wider range of customers than its competitors. Owning a massive portfolio of high-use medicines would also increase Amazon’s negotiating power with PBMs and offer more value to its end consumers.

Deepening Amazon’s foothold in healthcare. Amazon is already a major player in the healthcare market, with its One Medical acquisition, Amazon Clinic, and Amazon Pharmacy. By acquiring a generic drug manufacturer, Amazon could further solidify its position in the healthcare market and become a one-stop shop for all of its customers' healthcare needs.

Synergies with other business units. The most salient synergies are how “Amazon Medicines” would directly funnel supply of low-cost generics into Amazon Pharmacy and Amazon Clinic, reducing overall operating COGS for those business units and expanding the range of medicines they can offer. However the possibilities really start to get interesting with Amazon’s other business units.

Lowering drug costs for One Medical patients. With One Medical, where patients pay a yearly membership fee, imagine if that membership fee included no or heavily reduced out-of-pocket costs for all generic prescriptions if filled through Amazon Pharmacy.

Scaling the value of RxPass. As noted in table 1, RxPass is Amazon Pharmacy’s “Netflix model” for drugs. For $5 per month, Prime members can get access to certain medications for one low price. Integrating a generics arm into the Amazon healthcare ecosystem could enable expansion of this pricing model into broader sets of medications and potentially improve the economics of a drug subscription model.

Improved healthcare decisions via data integration. What if your medical data was integrated your purchasing data? Amazon apps and Alexa could send notifications to you warning you of contraindicated foods you purchased at Whole Foods. Your OneMedical care team could design a specific nutrition plan that optimizes the mechanism of action of the prescription medication you are taking and even pre-populate or pre-order the right groceries for you to take home. Your medical practitioner could have a more wholistic view of your day-to-day life, enabling them to provide you with more accurate and actionable preventative care.Patients with amazon smart home devices could get regular reminders to take their medicines for chronic medications, reducing prescription abandonment, increasing compliance, and potentially improving outcomes

New ways to pay for Prime members. Prime members with the Amazon Prime Credit Card already gain 5% cash back on all purchases at Amazon and Whole Foods. What if Prime members could fully purchase prescriptions with accrued cash back?

Simplifying prior authorizations. For medications that may require prior authorization (PA), Amazon could leverage its wealth of cloud computing and AI capabilities to automatically file PAs for prescribers. Your care provider could one day simply speak into an Alexa speaker to get this done in an instant.

Driving subscription growth. Amazon could reserve access to many of the synergies and benefits noted above exclusively for Prime members. This could drive increased membership growth in older demographics, who rely on chronic medications and see signing up as a net benefit. Increase membership flow because of healthcare could lead to increased sales on other non-healthcare Amazon business units.

Potential Benefits to Consumers

Lower prices for consumers. Amazon could use its portfolio power to negotiate for lower prices for generic drugs, which would save consumers money. Amazon could run the same playbook as MCCPDC and offer an even lower markup, to its customers, pushing costs down even further. Pair that with Amazon’s high quality customer service and mastery of logistics, this could lead to a lower cost, more customer-centric, and more efficient Pharmacy experience for patients.

Improved access to medicines. Amazon could expand its online pharmacy offerings and make it easier for customers to order generic drugs, which would improve access to these medications.

Increased competition in the generic drug market. Amazon's entry into the generic drug market would increase competition, which could lead to lower prices and improved quality for consumers.

Potential Challenges

There are also a number of potential challenges that Amazon would need to overcome in order to make an acquisition of a generic drug manufacturer a success. These challenges include:

Regulatory hurdles. There are a number of regulatory hurdles that Amazon would need to overcome in order to acquire a generic drug manufacturer. These hurdles include antitrust concerns and approval from the Federal Trade Commission. Big Tech seems to always be in the Federal Government’s crosshairs, regardless of what party is in power. Amazon may feel that the SEC waiving through this deal or any blockbuster size deal they make would be quite low. The temperature on data privacy concerns would likely get turned up with addition of healthcare data in the mix, presenting increased headwinds for a deal like this to get done. With Amazon’s healthcare business gaining significant foothold, this could also increase pressures to break up the broader company into separate business.

Competition and perception. The generic drug market is already highly competitive. Amazon could feel like maneuvering into the drug business is too big a leap at this juncture. While Amazon has taken big swings in healthcare, many of these strategic bets (as noted above) have been failures. Investors may not look upon acquisition of a drug company favorably and could prefer that Amazon make deals within the tech arena instead.

Better Alternatives. The company may feel that partnership with one of the big generics players is a better alternative, offering a lower-risk option that enables Amazon to realize most of the benefits I characterized above. Additionally, the company may not view drug manufacturing and distribution as the area where its core competencies can add the most value. Perhaps they view creating a health insurance alternative as an easier venture that better aligns with its core capabilities and would require less physical footprint.

Conclusion

The acquisition of a generic drug manufacturer would be a strategic move that would further solidify Amazon's position as a leader in the healthcare market. The acquisition would allow Amazon to expand its healthcare business, lower prices for consumers, and improve access to generic drugs, and outcompete other players in the space. Meaningful synergies between the acquired drug business and Amazon’s other healthcare entities and non-healthcare entities could lead to innovative solutions that add value for customers and enable the company to massively scale novel business models like cost-plus and subscription in ways that other companies simply do not have the power to do. Notably, there are also a number of challenges that Amazon would need to overcome in order to make the acquisition a success, most saliently the threat of regulatory action against a big tech player growing in power, concerns about data privacy, and the risk of increased political pressure to break up Amazon into its component business.